Multi-state marijuana producer Planet 13 Holdings (PLNH.F +0.00%) released its quarterly results last month. The results, unfortunately, failed to inspire much excitement. Despite Planet 13 reporting some encouraging year-over-year growth for the period, there hasn't been a surge in investors buying up the stock since then.

Below are three of the most surprising and noteworthy items I found on the company's earnings report, which can give investors a quick snapshot of just how Planet 13 did in its most recent quarter, and help assess whether it's a good buy today.

Image source: Getty Images.

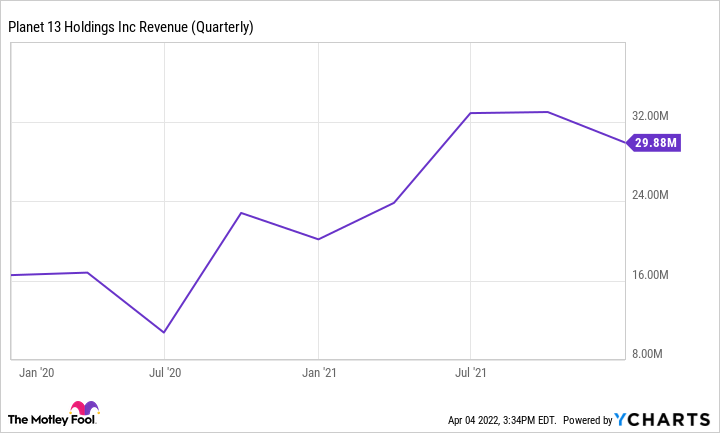

1. Sales were down 9% quarter over quarter

Planet 13's revenue for the three-month period ending Dec. 31 totaled $29.9 million and rose 48% year over year. Its market share remained above 10% in Las Vegas. And in California, it noted that its Orange County store generated quarter-over-quarter growth of 7.2% despite the California market being down during the period. However, the company's total revenue in the third quarter was just under $33 million, meaning that in the fourth quarter, the top line contracted by more than 9%. The company has been generating strong growth in the past few years but sales have stalled of late, despite Planet 13 entering a new market in California:

Planet 13's operations still largely hinge on the Las Vegas market and its SuperStore location there. It was less than a year ago that it opened its location in Orange County, so it shouldn't be a surprise that in that market, the company is generating positive growth while other businesses that have been around for longer aren't able to do so. In the quarter, management stated that just $2.6 million of revenue came from the California market and $5 million for the entire second half of the year.

OTC: PLNH.F

Key Data Points

2. Gross margins have remained strong at over 50%

One positive surprise from the company's quarterly performance is that at 54%, its gross margins have remained fairly strong, even amid oversupply concerns in the market. A year ago, Planet 13 reported a gross profit margin of just 42.7%. For the full year, its gross margin in 2021 was 55.2% compared to 49.8% in 2020.

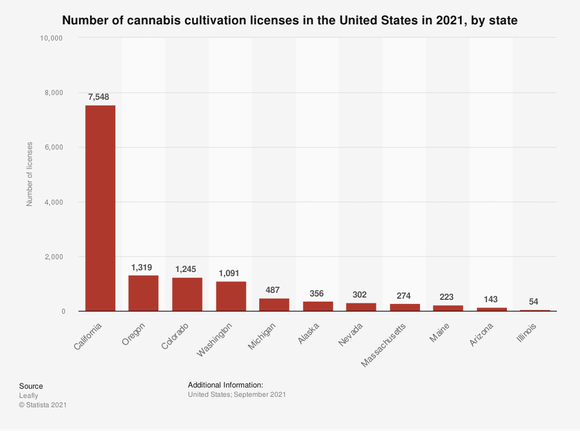

However, the big test will be whether these margins can hold up as the company builds up its sales in California, where oversupply issues are among the worst in the country. Those issues are not a surprise given the number of cultivation licenses there are in the state:

Image source: Statista.

Although California's population is 13 times the size of Nevada's, it has 25 times the cultivation licenses.

3. Planet 13 spent $15.6 million on stock-based compensation

In its earnings reports, Planet 13 reported a net loss of $19.5 million for the full year. Although that was an improvement from a $25 million loss a year ago, the company was still deep in the red. What was surprising is that despite this, the company was nearly cash-flow positive from its day-to-day operating activities. It was able to do that by funding $15.6 million of its expenses through share-based compensation. While that doesn't use up cash, it uses stock, which has a dilutive effect on shareholders. That was more than six times the $2.5 million in stock-based compensation the company reported a year earlier.

As Planet 13's expenses rise with its focus on expanding into the California market, investors should keep a close eye on these types of costs. Although they're not cash-based expenses, they can still hurt the stock's performance.

Is Planet 13 a buy?

Overall, there were more negatives than positives in Planet 13's latest earnings report. Although the cannabis company is expanding in California, that might be the worst market to move into right now as it's the most competitive, which could create challenges ahead for the business.

At a price-to-sales multiple of over four, Planet 13 is also trading at more of a premium than larger, more diversified businesses in the cannabis sector:

PLNHF PS Ratio data by YCharts

I don't see a way of justifying a premium for Planet 13 over either Curaleaf or Trulieve Cannabis. There are simply better options out there today than Planet 13 for cannabis investors to consider, and these latest results don't do anything to change that.