Buying stocks during a bear market can yield spectacular returns. For instance, the calamitous bear market brought on by the Great Recession cratered the S&P 500 by 56.8%, from peak to trough. But smart investors knew it was a once-in-a-lifetime opportunity to buy.

The index closed on March 9, 2009, at its bottom of 676.53. The ensuing bull market rally lifted the S&P 500 to its peak of 3,386 11 years later, on Feb. 19, 2020. Steadfast buy-and-hold investors would've achieved a remarkable 400.5% gain just by buying the index.

Buying an index is not a bad idea. But bear markets allow smart investors to buy beaten-down shares of great companies, outperform the market, and accumulate phenomenal wealth.

What if you bought Apple during the Great Recession instead?

On the day the S&P 500 bottomed, Apple (AAPL 0.87%) closed at $2.53 per share (adjusted for stock splits). If you plunked down $1,000 at that price, you'd have 395 shares. If you also had the steady hand to never sell a single share for the entire 11-year rally, your shares would've been vaulted to $79.58 per share, netted you a head-turning 3,045% gain--dramatically outperforming the market.

Image source: Getty Images.

To put the whole thing in perspective, your guts to buy in a bear market, loyalty to the buy-and-hold strategy, and your $1,000 would've given you $31,434.10 at the market's top.

Here's how Apple did it

Apple released its first iPhone just two years before the Great Recession bear market, in June 2007. In 2008, the company shipped out 13.8 million iPhones. By 2009, iPhone shipments had nearly doubled to 25.1 million, putting it behind Nokia and Research in Motion. Apple's iPhone growth saw its market share increase from 9.1% in 2008 to 14.4% in 2009.

The iPhone's touchscreen and camera ushered in a new era of apps, internet connectivity, and selfies. The iPhone has long since left Nokia and Research in Motion in the dust and now controls about 50% of the U.S. smartphone market, and a sizable chunk of the global market. In 2021, Apple shipped 240 million iPhones, a 1,639% increase over 2008.

NASDAQ: AAPL

Key Data Points

Though Apple was built on the Mac, the iPhone has become Apple's largest source of revenue and profits. Along the way, the company introduced the iPod, iPad, and AirPods. But its next leg of growth may not come from hardware at all.

Is it too late to buy Apple?

Apple's most profitable and fastest-growing segment is its services segment. iPhone users likely know they can download music to Apple Music, store photos and videos to their iCloud account, and make touchless payments with Apple Pay. Each of the poplar services comes with a tiny fee that has made a big impact on Apple's profits.

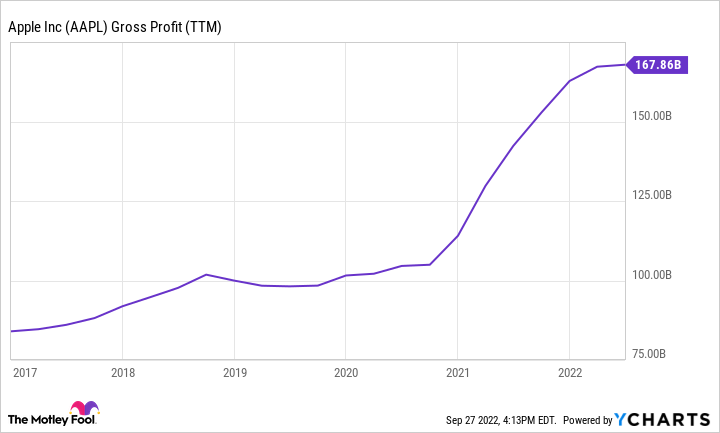

Apple first disclosed financial results for the segment in 2017 when it generated just shy of $18 billion in gross profits. By 2021, service gross profits had vaulted by 165% to $47.7 billion. The segment's gross profit margin reached 69.7% that year compared to 35.5% for products like iPhones and Macs.

AAPL Gross Profit (TTM) data by YCharts

Apple has plenty of room to grow its services business and continue to expand its profitability. For instance, the COVID-19 pandemic has inspired folks to use touchless Apple Pay more than ever before. Over the last 12 months, Apple Pay has transacted over $6,000 billion in payment volume, which is more than payment giant Mastercard. But 39% of Americans haven't even heard of it yet.

Apple's largest shareholder is Warren Buffett's company, Berkshire Hathaway. The company first started accumulating shares in 2016. The shares have backtracked during this year's bear market, and the company bought more shares in both the first and second quarters of this year. Apple stock is about the same price as when Buffett bought shares this year. Investors wondering if Apple is still a good value have the stamp of approval from the Oracle of Omaha.

Buy now or wait?

There is no telling when today's bear market will give way to the bulls. But the stock market is always looking forward. So, the risk of waiting for good macroeconomic news is missing out on the recovery. Buying the stocks of great companies at depressed prices is a recipe for market-beating returns. Even if it means the bear market persists for a while, it's better than suffering from the regret of missing out on opportunities like this.