Consumers and businesses worldwide have rushed to integrate artificial intelligence (AI) into their workflows. The launch of OpenAI's ChatGPT at the end of 2022 reignited interest in the technology and highlighted its potential to improve efficiency in countless industries.

Increased demand for AI services has trickled down across tech, creating a greater need for high-performance chips that make AI possible and cloud services that make it easy for businesses to adopt AI tools. As a result, the Nasdaq Composite has climbed 63% since the start of 2023, creating many millionaires.

Yet, the AI industry is still in its infancy, indicating it has much to offer companies and investors over the long term. According to Grand View Research, the market hit close to $200 billion in spending last year and is expected to reach just under $2 trillion by 2030. As a result, it's not too late to enjoy major gains from AI as the industry develops.

So, here are two millionaire-maker AI stocks to buy this September.

1. Nvidia

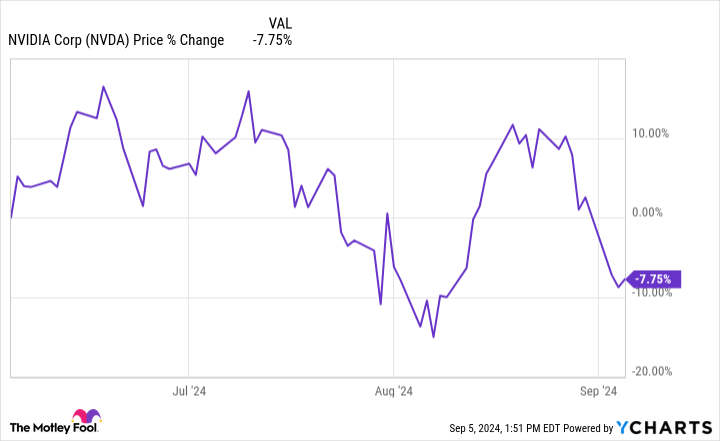

Nvidia (NVDA +3.93%) investors have been on a roller coaster over the last three months. Despite a glowing earnings release at the end of August, a sell-off has seen its share price dip 8% since June.

Data by YCharts

This chart illustrates the significant peaks and valleys Nvidia investors have endured in recent months. The most recent dip was triggered when Bloomberg reported on Sept. 3 that the U.S. Justice Department had sent a subpoena to Nvidia based on antitrust concerns. The DOJ allegedly accused the company of making it difficult for companies to choose competing chip suppliers. Nvidia's stock plunged 12% following the report.

However, Nvidia responded to the claim the next day, denying it had received any subpoena from the DOJ, but was "happy to answer any questions regulators may have." The situation highlights the importance of investing with a long-term mindset with tech stocks and the compelling argument for buying the dip.

NASDAQ: NVDA

Key Data Points

Despite recent declines, Nvidia's stock is up 26% in the last six months. The company has created many millionaires over the years as its chips have become the gold standard for AI developers worldwide. Its success has boosted its operating income and free cash flow by 79% and 92% in the last year, as chip sales have skyrocketed. Its cash hoard is expanding quickly, increasing its edge in AI with more spending power to improve its technology.

Nvidia's forward price-to-earnings (P/E) ratio is high at 38. However, that figure is down nearly 40% since January, as earnings have consistently risen. Alongside its dominant role in AI and growing cash reserves, now is an excellent time to invest in a stock with a history of making millionaires.

2. Alphabet

Alphabet (GOOGL +1.47%) (GOOG +1.55%) is a fairly new company compared to its competitors, founded 26 years ago in 1998. Microsoft and Apple are within a couple of years of being 50 years old, with Amazon established 30 years ago. As a result, it's impressive how far Alphabet has come in such a relatively short time, with its market cap of $1.9 trillion making it the world's fourth most valuable company.

The company has made many millionaires over the years, delivering stock growth of 6,000% since it went public in 2004 for $85 per share. Meanwhile, revenue and operating income have risen 13,000% and 9,000%, respectively, since then.

Alphabet's success is mainly thanks to the potency of its Google brand, which has seen it branch out to numerous markets, from search engines to productivity software, cloud computing, smartphones, digital advertising, video sharing, and more. Products like Google Chrome, Mail, and Search have made it almost impossible to access the internet without using an Alphabet product.

NASDAQ: GOOGL

Key Data Points

The company's dominance has triggered antitrust concerns from the Department of Justice, which believes Alphabet should make it easier for consumers to choose competing search engines. As a result, the tech giant could be forced to implement screens that allow users to choose between different search engines. However, with over 91% market share in search, Alphabet is unlikely to be impacted in a major way.

Moreover, Alphabet's business is gradually leaning more on AI to boost earnings. Over the last year, the company has ramped up its investment in the industry by adding generative features across its product lineup. Alphabet's Google Cloud platform has massively profited from the AI push, with revenue popping 29% year over year in the second quarter of 2024. Additionally, the company is updating Google Search with AI to stay competitive against rivals like ChatGPT and Microsoft's Bing.

Alphabet's forward P/E currently sits at an attractive 21, an industry low in "Big Tech." Alongside $61 billion in free cash flow, a potent brand, and an expanding role in AI, Alphabet is a bargain stock worth considering right now.