Nvidia (NVDA +0.99%) is the undisputed leader in the artificial intelligence (AI) chip market these days. It has been generating fantastic growth in both its revenue and earnings, and the expectation that there's much more growth ahead is why many investors aren't shying away from buying the stock, despite its high valuations.

Two of Nvidia's key rivals, Advanced Micro Devices and Intel, are hoping to chip away at its market share. While it's possible that some of its customers may want to diversify their supply chains and explore cheaper options, Nvidia's recent announcement of its new graphics cards is a sign that it isn't about to relinquish any of its market share easily.

NASDAQ: NVDA

Key Data Points

New Nvidia cards are cheaper than expected

One way AMD and Intel could potentially win over customers is by offering them more modestly priced chips. While Nvidia's high-performing chips are in heavy demand, they don't come cheap. Tech companies developing AI models and chatbots have shown that they are willing to pay a premium for the chips, but price could play a bigger role in purchasing decisions down the road, especially if AMD or Intel can prove that their chips aren't significant downgrades from Nvidia's latest offerings.

But Nvidia is showing that it's willing to be a bit more aggressive on price. On Jan. 6, the company unveiled its latest GeForce RTX 50 cards, and what took some analysts by surprise was that many of them will be priced lower than the previous RTX 40 series, despite offering significant performance upgrades.

Nvidia also announced Project Digits -- the first desktop computer it will make. But at a price tag of $3,000, it isn't cheap, and is designed primarily for programmers.

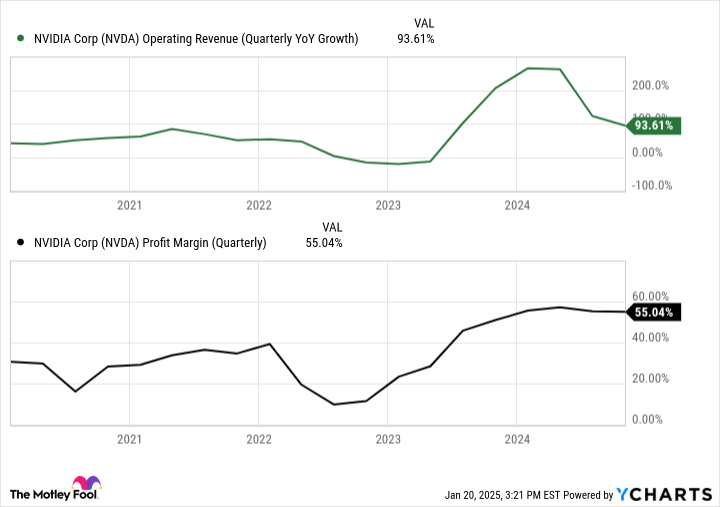

Nvidia's strong margins allow it to be aggressive

When a company is as big and profitable as Nvidia is, it's in an excellent position to compete on price and also pursue more aggressive opportunities. Not only has the company drastically grown its revenue over the years, it has done so while increasing its profit margins.

NVDA Operating Revenue (Quarterly YoY Growth) data by YCharts.

With such strong margins, the company can afford to offer some of its wares at lower prices, knowing that it can still maintain a high level of profitability. Doing so could potentially thwart competitors, as chips from AMD or Intel may not be comparatively cheap enough to win over customers.

There are reports that AMD is holding back the official launch of its new Radeon RX 9000 series chips due to Nvidia's announcement and the pricing pressure that has come as a result of it.

Should investors load up on Nvidia's stock?

Nvidia's stock has plateaued in the past three months, and investors appear to be having some hesitancy about buying it at its current levels. The company, which has a market cap of $3.4 trillion, is trading at a forward price-to-earnings multiple of 32, which is slightly higher than the Technology Select Sector SPDR Fund's average of 30. However, given the growth beast that Nvidia is, a bit of a premium over the average tech stock may certainly be warranted.

Given the long-term growth opportunities ahead for Nvidia, it's hard not to like the stock as a long-term buy. The company's financials are in excellent shape, and with Nvidia looking to be more aggressive on pricing and expanding its growth opportunities, it's not unreasonable to expect that its sales and profits can go even higher in the years ahead. Overall, it could be a good growth stock to buy and hold onto, despite its high valuation.