Artificial intelligence (AI) stocks remain the talk of Wall Street. And two of the most high-profile stocks are Nvidia (NVDA 3.09%) and Advanced Micro Devices (AMD 3.55%).

Nvidia has been the big winner of the AI boom, but is it now AMD's time to shine? Let's dig in and find out.

Image source: Getty Images.

Advanced Micro Devices

First, let's have a look at Advanced Micro Devices.

NASDAQ: AMD

Key Data Points

After years of outperformance, shares of AMD have gone nowhere since the start of 2022. Indeed, AMD's stock is down 21% over the last three years.

So, what's happened to this former favorite, and can AMD get its mojo back?

In short, AMD has hit a speed bump. After years of growing revenue and profits, business slowed as personal computing sales slowed following the COVID-19 pandemic.

Consider the slowdown in AMD's revenue. Between 2020 and 2023, the company more than tripled its revenue from $7.2 billion to $23.6 billion. However, over the last two years, the company's revenue is nearly flat, having grown by less than $1 billion.

Similarly, AMD has reported net income of $1.8 billion over the last 12 months. In 2021, the company's net income stood at nearly $4 billion.

In order to turn its fundamentals around, the company is counting on increased demand for its AI chips. AMD has a new GPU, the MI325X, meant to compete with Nvidia's Blackwell. If AMD can eat away at Nvidia's market share, the company's stock could finally take flight after years stuck on the runway.

Nvidia

So, what about Nvidia?

NASDAQ: NVDA

Key Data Points

Obviously, Nvidia has been the AI chip stock to own. Shares have advanced by more than 700% since the start of 2023.

But how much gas does Nvidia have left in the tank? Let's take a look at how far Nvidia has come and where analysts expect it to go.

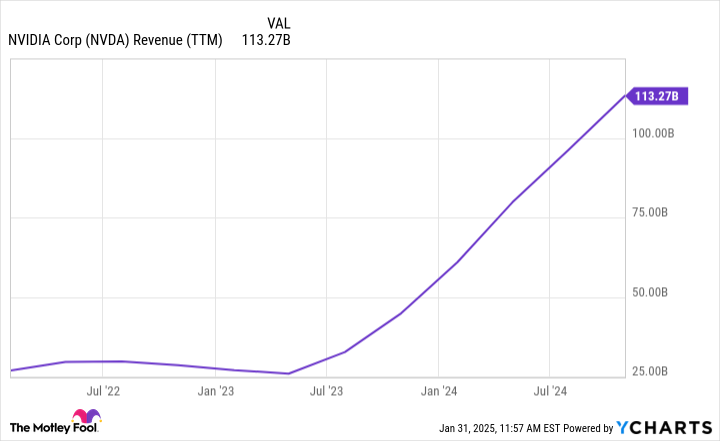

First, there's revenue. Nvidia has more than quadrupled its revenue in less than three years.

NVDA Revenue (TTM) data by YCharts

Average quarterly revenue growth since the start of 2023 is an eye-popping 127%. Similarly, net income has soared from around $4.4 billion to more than $63 billion. It's stunning growth.

What's more, analysts don't expect a slowdown. According to consensus estimates compiled by Yahoo! Finance, Wall Street analysts forecast Nvidia to generate $196 billion in sales next fiscal year (the 12 months ending on Jan. 28, 2026). That would mean Nvidia would nearly double its already staggering sales in just a year. For context, it would catapult Nvidia from 32nd to 15th in the ranking of largest American companies by revenue -- passing legendary names like Ford, General Motors, and Home Depot along the way.

Which is a better buy?

Here's where we get to the heart of the matter.

Yes, Nvidia has massively outperformed AMD recently -- but which company is poised to deliver the better return going forward?

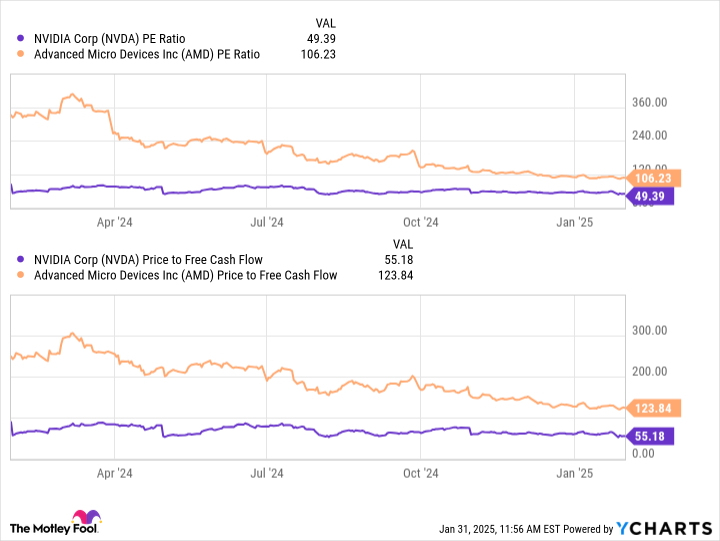

For me, the companies' valuations provide a clue. That's because, despite Nvidia's incredible stock market run, it remains far cheaper than AMD across several metrics.

NVDA PE Ratio data by YCharts

Thanks to Nvidia's enormous growth of profits and free cash flow, it remains about half as expensive as AMD across both the price-to-earnings (P/E) and price-to-free-cash-flow (P/FCF) ratios.

Moreover, while AMD's AI chips have yet to truly take off with customers, there's no doubting the popularity of Nvidia's.

Granted, there are concerns with the overall AI chip market and whether it will grow as fast as expected. However, for investors looking for a pure play on AI chips, it's hard to argue that Nvidia is the name to own now and for the future, too.