The summer has traditionally been a slow period for online shopping, so what better time to consider adding the e-commerce giant Amazon (AMZN +0.26%) to your portfolio? The company just wrapped up its annual Prime shopping promotion, which has been a huge hit since launching a decade ago. The event has lifted sales and boosted Prime membership levels since 2015. It even forced competitors to launch their own sales promotions just to keep up . Prime Day in 2023 was the company's largest sales day in its history, and there are likely more records ahead for 2025 and beyond. But there are even better reasons to like this growth stock right now. Let's dive right in.

Rising profits

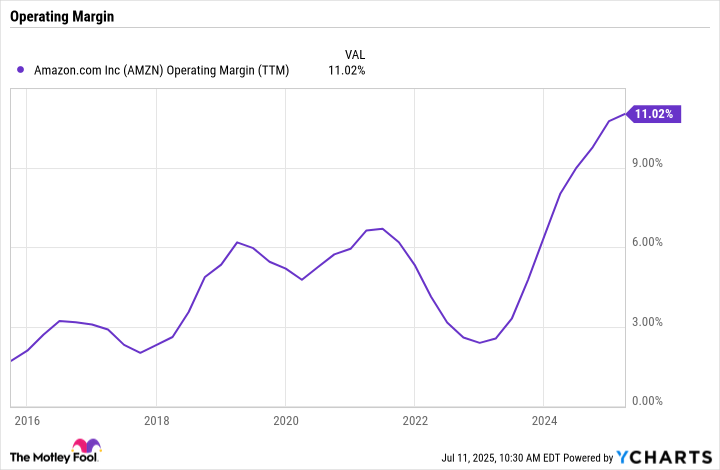

The biggest knock against Amazon stock over the years has been its lack of strong earnings to go along with its phenomenal growth. But those days appear to be over. Operating profit in 2024 jumped 86% to $69 billion. That jump was enough to push profit margin to 11% of sales from 6% of sales a year earlier. Not bad for a company that books over $600 billion in annual revenue .

AMZN Operating Margin (TTM) data by YCharts

Sure, there will be ups and downs ahead for these profit figures, since Amazon still has dozens of attractive growth investment avenues such as faster fulfillment, Artificial Intelligence (AI), and upgraded AWS hardware. CEO Andy Jassy called out the company's stepped-up pace of innovation as a highlight of Amazon's first-quarter start to 2025. Investors have reasonable expectations that these investments, on balance, will continue to boost profit margin over the long term .

Growth at scale

Amazon impresses on the growth side of the ledger, too. Sales rose by double digits last year and have nearly doubled in the past decade. Some of that spike came from the one-time pandemic boom, of course.

Image source: Getty Images.

But AWS has been the fastest-growing unit in the company for years, expanding 19% in 2024 and 17% in the most recent quarter. That's great news for investors because it implies more profitability gains as AWS takes up a larger proportion of overall sales in the coming decade. The unit just passed $108 billion in annual revenue last year; more than all of Amazon generated just 10 years prior .

The price is right

Those impressive metrics wouldn't mean much if Amazon stock were priced too high to generate solid returns from here. But that's just not the case. You can own the business for 36 times earnings today, representing a slight discount compared to Microsoft (MSFT +0.22%). The valuation looks even better on a price-to-sales basis, where Amazon weighs in at 4 times sales compared to Microsoft's 14 times sales. Of course, the best reason for that valuation gap is that Amazon's profit margin, although much improved in the past decade, is just 11% compared to Microsoft's blazing 45% figure.

No one is projecting that Amazon will approach anything near that level of profitability in the next several years. However, even minor margin gains as the business grows its influence, both in retail and in cloud services, should be enough to produce market-thumping returns for shareholders from here. That's why you should consider adding some of this stock to your portfolio this summer. Perhaps you can then use a small portion of the proceeds when you want to splurge during the company's July Prime Day promotions in a few years.