Artificial intelligence (AI) stocks have been under pressure lately. A combination of factors, such as concerns about AI being in a bubble, circular financing deals, and questions whether the massive AI infrastructure investments will indeed pay off, are weighing on this sector.

Investors, however, shouldn't forget that AI companies have been clocking impressive growth, driven by the fast-growing adoption of this technology, which is delivering productivity gains. A survey of 500 business decision makers in the U.S. carried out by consulting giant EY revealed that 96% of the organizations investing in AI are witnessing higher productivity, with 57% of them experiencing significant gains.

Not surprisingly, nearly 90% of the surveyed subjects pointed out that they are reinvesting their AI-fueled gains into existing capabilities and developing new AI tools. So, it won't be surprising to see companies continue to invest in AI in 2026. That's why it is a good time to take a closer look at Applied Digital (APLD +5.48%), a company that's playing a key role in the proliferation of AI.

Image source: Getty Images.

Applied Digital can sustain its remarkable rally in the new year

Applied Digital designs, builds, and operates dedicated AI data centers. It also offers turnkey cloud computing solutions to help customers run AI workloads at low costs.

The company is currently building a couple of data center complexes in North Dakota for its customers. Applied Digital has already deployed 100 megawatts (MW) of capacity for its customer CoreWeave at the Polaris Forge 1 complex. It intends to bring another 150 MW online next year at Polaris Forge 1. Meanwhile, Applied Digital estimates that it will complete the deployment of another 150 MW at its second data center complex, known as Polaris Forge 2, in 2026.

The good part is that Applied Digital has already signed lease contracts for all the 400 MW of capacity that it is constructing at Polaris Forge 1. The company will receive $11 billion over fifteen years for the 400 MW of leases that it has signed for the complex.

NASDAQ: APLD

Key Data Points

What's more, it recently announced a 15-year, $5 billion lease for 200 MW of capacity at Polaris Forge 2. As a result, the company should start witnessing a substantial jump in its top line when it starts recognizing the lease revenue from next year. Not surprisingly, analysts are expecting Applied Digital's revenue growth to pick up in the future.

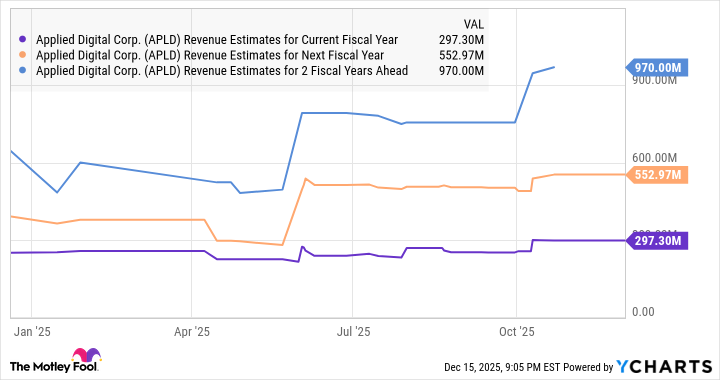

The company reported an 84% year-over-year increase in revenue in the first quarter of fiscal 2026 (which ended on Aug. 31) to $64 million. Analysts expect its top line to increase by 38% this year to $297 million, followed by a larger jump of 86% in fiscal 2027 to $553 million.

APLD Revenue Estimates for Current Fiscal Year data by YCharts.

This solid acceleration in Applied Digital's revenue growth is precisely the reason why the stock is likely to keep rising in 2026, following stunning gains of 200% in 2025.

The stock can easily crush Wall Street's expectations in the coming year

Applied Digital has a 12-month median price target of $40, suggesting 76% gains from current levels. However, it can easily go past that mark and double.

We have seen in the previous chart that Applied Digital's revenue in the current fiscal year (which will end in May next year) is set to land at just under $300 million, suggesting that it is on track to generate around $150 million in revenue for the last two quarters of fiscal 2026.

Applied Digital's revenue in fiscal 2027 is projected to land at $552 million. Assuming it achieves half of that revenue -- $276 million -- in the first two quarters of fiscal 2027 (for the six months that will end in November 2026), its trailing-12-month revenue after a year should stand at $426 million. The stock is currently trading at 36 times sales, which is undoubtedly expensive.

However, that multiple can be justified by the terrific pace at which Applied Digital is growing. After all, the company has a robust long-term lease-revenue pipeline that's going to supercharge its growth from next year. So, there is a possibility of Applied Digital maintaining the premium sales multiple it is trading at after a year.

If Applied Digital achieves $426 million in revenue over the next four quarters, its market value could jump to $12.8 billion even if it trades at 30 times sales after a year. That's double the current market cap, suggesting that this high-flying AI stock is on track to deliver phenomenal gains to investors once again in 2026.