Nvidia (NVDA 3.81%) and Broadcom (AVGO 4.48%) are among the leading names in the artificial intelligence (AI) hardware space. Their chips are deployed in massive numbers by cloud computing companies, hyperscalers, and AI companies for AI model training and inference.

Not surprisingly, both Broadcom and Nvidia have been witnessing remarkable growth lately. Nvidia reported an impressive 62% jump in revenue last month for the third quarter of fiscal 2026 (which ended on Oct. 26) to $57 billion. Even Broadcom just reported a solid 28% year-over-year increase in revenue for its latest quarter, driven by a terrific year-over-year jump of 74% in AI revenue.

These solid results explain why their shares are up nicely in 2025. While Broadcom stock has jumped 47% this year, Nvidia is sitting on respectable gains of 32%. The good part is that both companies still have a lot of room for growth, but their expensive valuations could limit their upside in 2026. However, there’s one AI infrastructure play that’s significantly cheaper than both Nvidia and Broadcom despite soaring a stunning 147% this year -- Ciena (CIEN 2.83%).

Let’s see why this company could continue to outperform Nvidia and Broadcom in 2026.

Image Source: Getty Images

Ciena’s growth is set to accelerate in 2026

While Broadcom and Nvidia make AI processors that help train large language models (LLMs) and run AI inference applications, Ciena’s optical networking components and software ensure that their chips can perform optimally. After all, Ciena’s products, which include routers and switches, ensure high-speed data transmission over fiber networks.

NYSE: CIEN

Key Data Points

Its offerings are used in data centers, telecom networks, and cloud computing to move massive amounts of data quickly over long distances. This explains why Ciena has been witnessing healthy growth lately. The company released its fiscal 2025 fourth-quarter results (for the three months ended Nov. 1) on Dec. 11.

Ciena reported a 20% increase in revenue from the year-ago period to $1.35 billion. Its non-GAAP earnings jumped by a much stronger pace of 68% from the year-ago quarter, driven by an improvement in the top line as well as a stronger mix of software sales. More importantly, Ciena is expecting its revenue growth to accelerate in the current quarter.

It anticipates a 30% year-over-year increase in revenue at the midpoint to $1.39 billion. Ciena management remarked on the latest earnings conference call that it is now experiencing stronger demand for its networking products from Meta Platforms, which is going to contribute toward the bigger jump in its top line.

Meta is going to deploy Ciena’s solutions in “multiple new data centers.” Ciena management also added that it is “engaged in advanced technical discussions with additional hyperscalers” to supply its data communications products in their data centers. So, there is a possibility of Ciena’s revenue growing at a faster pace than the 24% increase that it is currently expecting for fiscal 2026 to $5.9 billion.

The company’s top line jumped by 19% last year, and the guidance for the first quarter suggests that it could easily overhaul its full-year forecast. Importantly, Ciena can sustain the acceleration in its growth in the long run as well. That’s because AI data centers reportedly require five times more optical connections as compared to traditional data centers.

The size of the AI data center market is poised to grow at an annual rate of 27% through 2032. This explains why analysts have become more bullish about Ciena’s prospects.

CIEN Revenue Estimates for Current Fiscal Year data by YCharts

What’s more, they are forecasting its top-line growth to filter down to the bottom line as well and expect the company to witness stronger earnings growth thanks to a potential improvement in its margin profile.

CIEN EPS Estimates for Current Fiscal Year data by YCharts

The strong growth in the company’s top and bottom lines could send the stock soaring in 2026 and beyond. In fact, it won’t be surprising to see it outperforming both Nvidia and Broadcom in the new year as well.

This networking stock could keep crushing the AI infrastructure stalwarts

We have already seen that Ciena’s fiscal Q1 revenue is on track to increase by 30% from the year-ago period. Though the company’s fiscal 2026 revenue growth guidance of 24% is lower than what it expects to achieve in the current quarter, there is a chance that it could exceed expectations for the full year.

Ciena received $7.8 billion worth of orders in the previous fiscal year, which exceeded its annual revenue of $4.8 billion by a big margin. It ended fiscal 2025 with a revenue backlog of $5 billion, pointing out that this figure “supports a large share of our fiscal 2026 revenue expectations.” Ciena’s impressive backlog and its negotiations with other hyperscalers suggest that the company is on track to exceed the $5.9 billion revenue estimate for fiscal 2026.

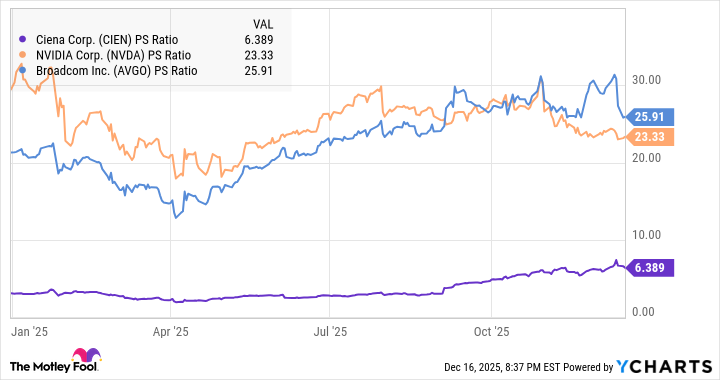

Assuming it can consistently maintain a 30% growth rate throughout the year, its top line could hit $6.25 billion (based on the fiscal 2025 revenue of $4.8 billion). Ciena is currently trading at just 6.4 times sales, which is significantly lower than the two other AI stocks discussed in this article.

CIEN PS Ratio data by YCharts

The U.S. technology sector has an average price-to-sales ratio of 8.7. If the market rewards Ciena with a premium valuation owing to its accelerating growth, and it trades at even 10 times sales after a year, its market cap could jump to $62.5 billion (based on the $6.25 billion revenue it could generate this year). That will be more than double its current market cap, suggesting that it can deliver stronger gains than Broadcom and Nvidia in the coming year, as per their 12-month median price targets.

So, investors can consider buying Ciena stock hand over fist going into 2026 as it can sustain its red-hot rally in the new year.