Quantum computing investing has fallen out of style with investors. That market is currently taking a risk-off approach with artificial intelligence and AI adjacent stocks, like quantum computing. As a result, many of the quantum computing stocks have sold off. However, that selloff is mostly tied to the quantum computing pureplays and doesn't affect my top quantum computing stock pick for December.

Of all of the companies competing i the qunatum computing realm, Alphabet (GOOG 2.36%) (GOOGL 2.38%) is my top pick. While it doesn't have the upside of the smaller quantum computing players, it is far steadier. Furthermore, Alphabet has resources that its competitors can only dream of, giving it an advantage over the long term.

Image source: Getty Images.

Alphabet has already proven its prowess in the quantum computing space

Alphabet isn't going all-in on quantum computing like some of the smaller companies. For them, they must achieve quantum computing supremacy, or they will go to $0. That's a monumental task, and many will fail. Alphabet doesn't need its quantum computing endeavors to succeed, as it's developing the technology for in-house use and to rent out through its cloud computing division, Google Cloud. Alphabet is paying billions of dollars to companies like Nvidia (NVDA 3.13%) for their graphics processing units (GPUs), and anything Alphabet can do to reduce input costs for future computing resources is a smart move.

Alphabet has already done this in the traditional computing realm, as it has developed its Tensor Processing Unit (TPU) in conjunction with Broadcom (AVGO 5.41%). This gives Alphabet some experience in developing custom computing hardware, which is valuable information for quantum computing.

NASDAQ: GOOGL

Key Data Points

Alphabet's quantum computing chip, Willow, has already made waves in the industry and is set to continue delivering impressive results heading into 2026. In October, Alphabet announced that its quantum computing chip ran the first verifiable algorithm in the industry. Its quantum computer ran the algorithm 13,000 times faster than the world's fastest supercomputer, which is an impressive improvmeen,t but not too fast that the quantum copmuter's work could be confirmed by traditional computing methods that are far more accurate.

This is a huge step towards commercial viability for Alphabet's quantum computing hardware, and investors shouldn't be surprised when Alphabet announces something similar again in 2026. Unlike some of the smaller quantum computing competitors, Alphabet doesn't need to announce every little breakthrough. This is because Alphabet is self-funding its research as opposed to the startups which ned money from research partners and the public markets to stay alive.

By not pleasing researchers and shareholders, Alpohabe is free to pursue its own will in the quantum world. That's a huge advantage, but the next one is even bigger.

Alphabet has resources its competitors can only dream of

Another reason why Alphabet is a top quantum computing stock pick is that it produces an enormous amount of cash that it can plow back into the quantum computing business if it chooses. Right now, a lot of that cash is being used to construct data centers for AI computing, but if quantum computing turns out to be all that it has been hyped up to be, it could easily devote a large chunk of its cash flows toward quantum computing.

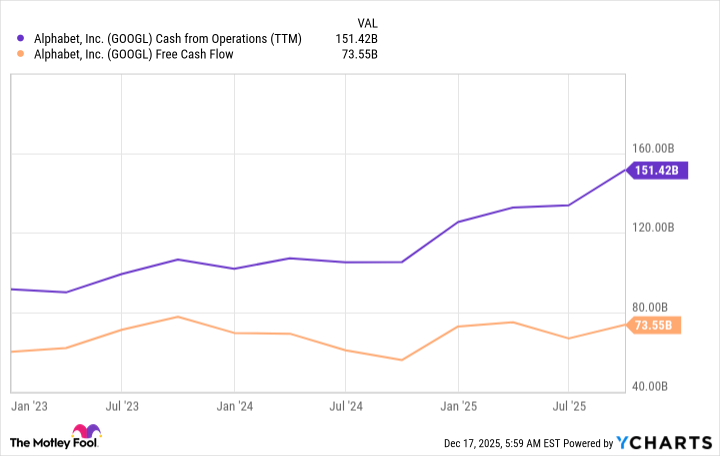

The two numbers that investors should familiarize themselves with are operating cash flow and free cash flow. Operating cash flow is the total amount of cash from operations that the business generates, while free cash flow is what's left after capital expenditures. While a vast amount of Alphabet's cash flows are going toward data center buildouts, it still has plenty available to fund quantum computing operations if it chooses.

GOOGL Cash from Operations (TTM) data by YCharts

$10 billion isn't much for Alphabet to throw at quantum computing -- a sum that the quantum computing upstarts could only dream of. Because of Alphabet's superior resources and a good start, I think it will be a force to be reckoned with by the time useful quantum computing comes about in 2030. It also isn't a boom or bust investment, making it a far safer place to invest than in one of the smaller competitors.