When it comes to investing in quantum computing stocks, it's natural for pure plays like IonQ, Rigetti Computing, or D-Wave Quantum to surface first in the conversation. What investors may not fully realize, however, is that a number of megacap tech companies are also exploring the advantages of quantum artificial intelligence (AI).

For instance, cloud hyperscalers Microsoft and Amazon have each designed their own quantum chips. Meanwhile, Nvidia offers a suite of software platforms that can be used in hybrid environments featuring classical and quantum computing.

When it comes to the best quantum computing stock, though, billionaire investors seem to have a clear winner. According to 13F filings from the third quarter, a number of high-caliber institutional investors have been pouring into Alphabet (GOOGL 3.21%) (GOOG 3.14%).

- Stanley Druckenmiller's Duquesne Family Office initiated a position in Alphabet, buying 102,200 shares.

- Israel Englander's fund, Millennium Management, increased its position in the company by 66%, adding 1.4 million shares in the third quarter.

- Ken Griffin's hedge fund, Citadel, bought 1.2 million shares during the third quarter, increasing his stake by 200%.

- Philippe Laffont's Coatue Management increased its stake in Alphabet by 259%, purchasing 5.2 million shares.

- Most notably, Warren Buffett added the company to Berkshire Hathaway's portfolio during the third quarter, buying 17.8 million shares worth roughly $4.3 billion.

Let's explore how Alphabet is quietly disrupting the quantum computing landscape. From there, I'll also break down how the technology fits into the company's broader ambitions in the AI market.

Image source: Getty Images.

How is Alphabet investing in quantum computing?

Google Quantum AI is the laboratory responsible for leading Alphabet's quantum computing efforts.

The company's Willow chip focuses on building scalable, error-correcting systems that specialize in solving complex problems that today's supercomputers simply cannot process.

It also released Cirq, a software tool kit that allows developers to research and refine quantum algorithms.

The real reason billionaires love Alphabet

Alphabet is far more than an internet business. While advertising revenue from Google and YouTube is the company's crown jewel, management has quietly integrated new AI services across its entire business.

Today, users can leverage Alphabet's large language model (LLM), Gemini, on the Google Search homepage as well as through the company's Android devices.

NASDAQ: GOOGL

Key Data Points

Google Cloud is also one of the fastest growing and most profitable segments of Alphabet's business, proving it can compete with incumbents like Amazon Web Services (AWS) and Microsoft Azure. A potentially lucrative component of Google Cloud that is yet to be fully launched is the commercialization of Alphabet's custom chips, called tensor processing units (TPUs).

Companies including Apple and Anthropic have already trained AI models using TPUs, and rumor has it that Meta Platforms is eyeing these custom chips for its next-generation of AI products.

Alphabet has masterfully stitched AI across the broader fabric of its ecosystem -- in search, advertising, cloud computing, consumer electronics, hardware, and even autonomous driving through Waymo.

In technical terms, Alphabet has vertically integrated its various assets, positioning it to remain resilient during just about any economic cycle and making its revenue and profitability profile especially durable.

Why Alphabet stock looks like a screaming buy heading into 2026

The takeaway from the details above is that quantum computing represents yet another piece of the foundation in Alphabet's broader AI pyramid. It's not commercially available today, but I see Google Quantum as a pillar of Alphabet's next wave of AI products that can be seamlessly integrated within the company's existing architecture.

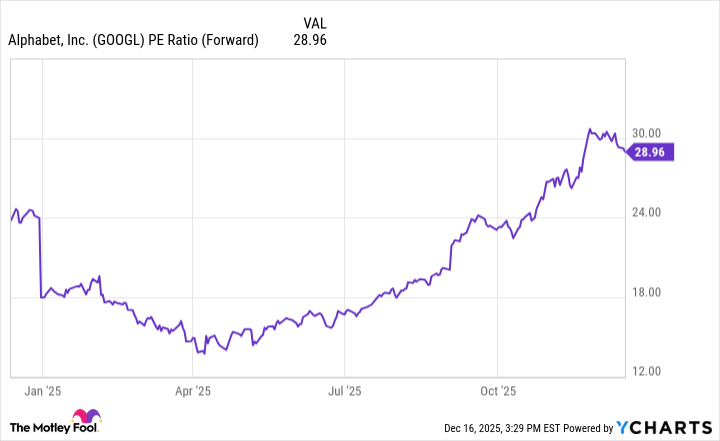

GOOGL PE Ratio (Forward) data by YCharts; PE = price to earnings.

As the graph above illustrates, Alphabet stock has been soaring lately. As a result, the company's valuation has become quite extended. While a forward price-to-earnings ratio of 29 isn't exactly cheap, I still see the stock as a compelling buy right now.

To me, the caliber of institutional capital flowing toward it at the moment is unrivaled. Despite the momentum, I see Alphabet's valuation as reasonable relative to the company's long-term upside.

In my view, the combination of the company's existing AI ecosystem and the upside of quantum computing make it unique in an otherwise frothy and fiercely competitive market. For these reasons, I see Alphabet as a screaming buy as 2026 approaches.