Coca-Cola (KO +0.43%) is one of the oldest companies still operating in the U.S., having gotten its start in 1886. It has gone through many changes over the 139 years, but it's still serving up refreshing beverages for loyal fans. Talk about staying power.

It has had many leaders over the year, and its current CEO, James Quincey, is stepping down from the top job in 2026. Let's see what that could mean for the company and its shareholders.

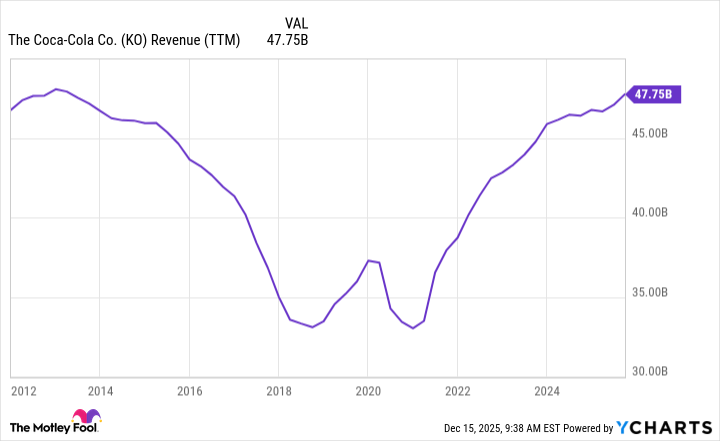

Coca-Cola had made a big comeback

Considering its position today, it might be hard to believe that Coca-Cola was struggling not so long ago. Before Quincey came on board, the company had been demonstrating declining sales for years; it only surpassed its previous record for revenue this year.

Quincey joined the team as CEO in 2017, and although he met with some positive movement, Coca-Cola had further pressure from the pandemic. He restructured the company, and it has maintained positive momentum for several years now.

Quincey is leaving the company in March, and current COO Henrique Braun will take over on March 31, 2026.

What will this mean for Coca-Cola?

In general, when long-established giants like Coca-Cola have a CEO switchover, it doesn't attract much notice. A company that's been chugging along for more than a century with a dominant position in the industry isn't expected to get a makeover with a new leader.

When there's a transition because a company is struggling, investors will take greater notice of whom the new CEO is and whether or not they think this person is going to be able to solve the company's problems. In this case, Braun's mission is going to be to keep Coca-Cola in the great shape that it is in today.

During its restructuring, Coca-Cola shed half of its brand portfolio, or 200 brands. These were small brands that accounted for a fraction of total revenue, freeing up resources to devote to the company's cash cows. Over the past few years, it has also acquired several billion-dollar brands. This new version of the company is highly focused on large brands that can move the needle. Since it can add new beverages to its powerful distribution network, these acquisitions boost revenue while keeping margins healthy.

Coca-Cola has been able to raise prices to counteract the effects of inflation on its costs, and it has remained healthy and profitable over the past few years. It also got a thumbs-up from the market this year for its local production chain, which helps the company avoid the biggest impact of tariffs. These features are built into the Coca-Cola system.

NYSE: KO

Key Data Points

What does this mean for shareholders?

In general, a CEO change at a company like Coca-Cola shouldn't lead to significant changes in the company, and Braun has been at the company since 1996. He's a Coke veteran who should be able to steer the company toward more success. I wouldn't worry about Coca-Cola.

Furthermore, the company offers stability for investors on the chance that the market doesn't continue to thrive in 2026. After three years of a strong bull market, the S&P 500 is highly valued, and investors should at least be cautious. Even if you're a growth investor, make sure you have some anchor stocks like Coca-Cola in your portfolio to protect it when there's market volatility. Take a page from Warren Buffett, who might be Coca-Cola's biggest fan; its Berkshire Hathaway's longest-held stock.

Coca-Cola is a Dividend King with one of the best dividend streaks on the market. The dividend yields 2.9% at the current price. That shouldn't change under any circumstances, since the company has paid and raised the dividend for the past 64 years through all kinds of global events and market crashes. (To be considered a Dividend King, a company must have raised its annual dividend for at least 50 years.)

Keep an eye on how the transition goes, but expect continued strength from Coca-Cola under Braun's leadership.