I have been appreciating Warren Buffett more than ever lately as the legendary investor prepares to step down from the helm of Berkshire Hathaway. Buffett has likely had the greatest influence on my investing journey because his buy-and-hold method resonates strongly with me. When Buffett makes a move, I tend to pay attention because I want to see what he and his management team see.

At the same time, I'm also a huge fan of tech stocks (which is an area that Buffett has often steered clear of). I think tech stocks are among the most interesting investments on Wall Street because the companies are often dynamic and bring innovation to every sector of Wall Street. Whether you have a consumer goods company, a financial services organization, or a healthcare operation, you rely on technological advancements to improve your business and stay ahead of the competition.

Recently, I have been paying closer attention to a company that offers the best of both worlds. It has outstanding management, strong earnings, and an insurmountable moat (just like Buffett prefers). And it also claims a front-row seat to how the world is changing and will be one of the most critical companies to help us get there.

My pick for the best buy-it-today-and-hold-it-forever stock is Alphabet (GOOG 0.47%) (GOOGL 0.54%).

Image source: Alphabet.

About Alphabet stock

Alphabet is a member of the "Magnificent Seven" group of stocks that's been dominating Wall Street for the last several years, and it's also one of the biggest publicly traded companies in the world. Currently, Alphabet has a market capitalization of $3.7 trillion.

The company's stock is up a whopping 61% this year, which is great considering that Alphabet got off to a rough start, falling into bear market territory in April before recovering.

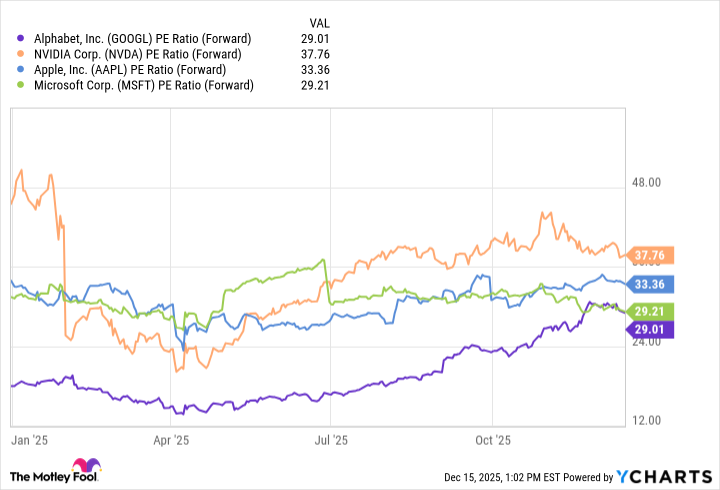

Of course, with that comes a hefty valuation, but considering the sandbox that Alphabet plays in, its forward price-to-earnings ratio isn't that bad. There are four companies on the planet with a market cap greater than $3 trillion, and Alphabet stacks up favorably to them all.

What to like about Alphabet stock

There are two major things I'm looking at with Alphabet right now. First is the company's business model and revenue. And all that is good. Alphabet just turned in its first-ever quarter of $100 billion in revenue, bringing in $102.34 billion in the third quarter, up 16% from last year. The vast majority of that comes from advertising, which brought in $74.18 billion in the quarter thanks to its powerful YouTube platform, as well as its dominant position in internet search, in which Google maintains a 90% market share.

All that helps Alphabet maintain 31% operating margin, with net income in the third quarter of $34.97 billion and $2.87 per share, up from $26.3 billion and $2.12 per share a year ago.

NASDAQ: GOOGL

Key Data Points

The second thing that I appreciate is Alphabet's innovation. Faced with a massive threat a year ago, as ChatGPT, TikTok, and other social media platforms threatened to cut into Google's search dominance, Alphabet harnessed the power of artificial intelligence (AI) to work in its favor. It rolled out AI Overviews on its search pages, generating summaries to answer users' queries using generative AI and advanced reasoning.

Alphabet also uses AI to optimize and improve advertising, and on YouTube to recommend content.

Finally, there's Google Cloud, the company's fast-growing cloud computing segment. Cloud computing is a growing field because companies running or training AI programs don't want to invest in expensive semiconductor clusters. Cloud services like Google Cloud are a more reasonable alternative, and it's one of the reasons why Google Cloud revenue jumped 33.5% in the third quarter from a year ago.

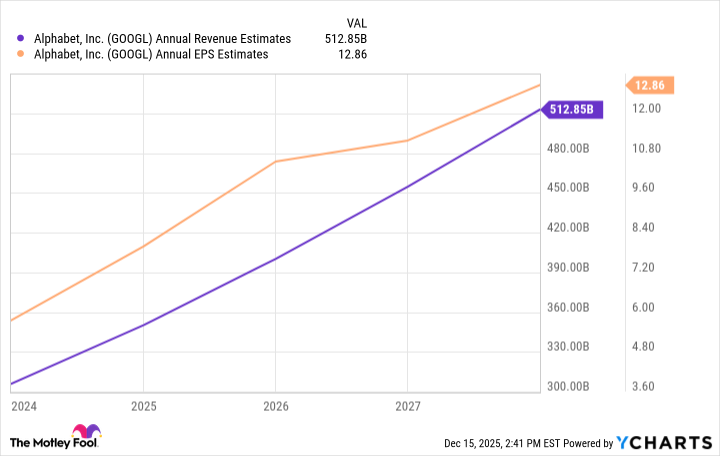

Alphabet's growth curve is expected to continue, which is impressive for a company of its size and maturity.

Alphabet is a buy right now

Of course, I also can't ignore that Berkshire Hathaway took a stake in Alphabet in the third quarter -- and while it's impossible to know if Buffett himself pulled the trigger, the purchase of nearly 18 million shares of Alphabet stock will go down in history as one of the last transactions under Buffett's reign as CEO.

The company's core advertising business is a profit center that can't be duplicated, despite efforts by competitors such as Microsoft, Meta Platforms, and Amazon to encroach on the digital advertising market. Alphabet has too many advantages, is too entrenched, and management has proven its ability to adapt to any challenges. Meanwhile, the Google Cloud opportunity will continue to provide outsize growth to Alphabet's bottom line.

I think it's the best stock to have right now for long-term investors.