Good companies don't go on sale very often. It isn't hard to understand why, since long-term investors tend to prefer owning good companies. So a reasonable price for a good company can be a huge buying opportunity. That's the story behind Coca-Cola (KO 0.11%) right now. Here are three reasons why investors might want to buy the iconic soda maker as if there were no tomorrow.

1. Coca-Cola is a well-run business

Coca-Cola is one of the world's largest consumer staples companies. With a market cap of $300 billion, it weighs in at number three behind two globally diversified retailers and more direct peer Procter & Gamble (PG 0.86%). Coca-Cola operates among an elite group of companies that have impressive global scale.

Image source: Getty Images.

However, there's more to the story here than just being big. Coca-Cola has a brand portfolio that is second to none in the non-alcoholic beverage niche. It possesses marketing and distribution strengths that are equal to those of any competitor. And it has an innovation team with a history of introducing attractive new products. Its size, however, is still a help on the product side, because Coca-Cola has the scale to act as an industry consolidator. That allows it to buy its way into new taste and flavor trends as needed.

It would be hard to find a consumer staples company that is managed better than Coca-Cola. Its massive market cap is a sign that investors recognize just how well run it is.

2. Coca-Cola pays you well to own it

Coca-Cola's strong business is highlighted in another way. It has increased its dividend annually for over six decades, placing it in the ranks of the Dividend Kings. A company can't build a dividend record like that without being well run. However, that record also shows that management and the board of directors place a very high value on returning value to shareholders via the dividends the company pays.

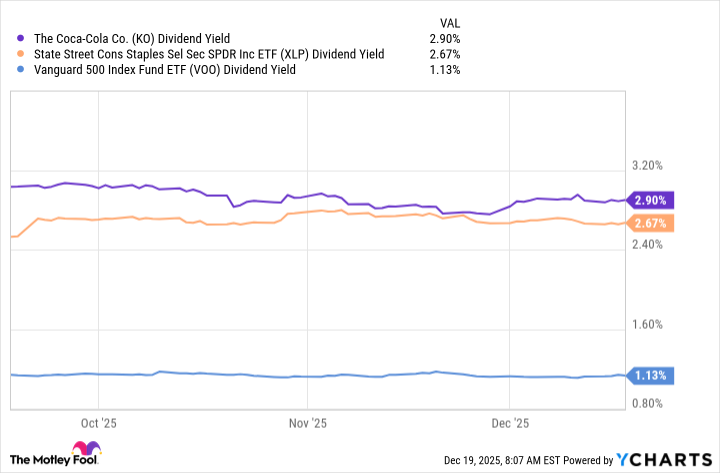

KO Dividend Yield data by YCharts

If you are an income investor, Coca-Cola's dividend track record will be a very attractive attribute. So, too, will be its 2.9% dividend yield. To be fair, you can find higher-yielding consumer staples stocks, but those investments will likely come with more risk. And 2.9% is still quite attractive today, considering that the S&P 500 index (^GSPC +0.96%) yields just 1.1%, and the average yield for a consumer staples maker is 2.7%.

It is hard to complain too much about a Dividend King with an industry-leading business that boasts an above-market and peer-average yield.

3. Coca-Cola looks fairly priced right now

Coca-Cola's relatively attractive yield hints at the last important factor here. Paying too much for a good company can turn it into a bad investment. However, the valuation metrics around Coca-Cola suggest you are paying a fair to slightly cheap price to buy it today.

Coca-Cola's price-to-sales ratio is roughly in line with its five-year average. The price-to-earnings and price-to-book value ratios, however, are both below their five-year averages. Looking to the future, the price-to-forward earnings ratio is also below its five-year average.

NYSE: KO

Key Data Points

None of these metrics suggests that Coca-Cola is in the bargain bin. That's not shocking, since it is actually performing quite well in a difficult consumer staples market. For example, despite consumers becoming increasingly cost-conscious, Coca-Cola's organic sales rose 6% in the third quarter of 2025, which was actually a slight improvement over the second quarter result.

It could be a great time to buy Coca-Cola

When you step back and look at the big picture, it is hard to be negative about Coca-Cola. You are looking at a fair price for a well-run business that continues to perform well, despite broader weakness in the consumer staples sector. And you are receiving a reliable and substantial dividend while you wait for investors to recognize the strong underlying value on offer here. If you are a conservative investor, now may be an opportune time to consider purchasing Coca-Cola.