Centrus Energy (LEU 6.25%) started 2025 with a share price of about $74. In mid-October, the stock hit a 52-week high of roughly $464 a share, representing a mouthwatering 527% gain. Since then, the stock has fallen about 50%, trading at around $234 at the time of writing.

NYSE: LEU

Key Data Points

Throughout all of this, Centrus has remained Centrus. It's still positioned to play a dominant role in U.S. uranium enrichment and even delivered 900 kilograms of high-assay, low-enriched uranium (HALEU) to the Department of Energy (DOE) in late June. So why did it crash?

Apparently, investors needed to reset their expectations for nuclear stocks, as Centrus wasn't the only company in this sector to fall (just look at Oklo). After a huge run like that, investors needed reminding that Centrus isn't a tech company, and its margins will never grow at the rate of, say, Nvidia.

The company seems to be on track for what could be another momentous year. Here's what's coming next.

Centrus is on track for another HALEU delivery

The first thing to know about Centrus is its contract work with the DOE. Since 2019, Centrus has been working with the DOE to produce HALEU at a DOE facility in Piketon, Ohio. In June 2025, that facility produced about 900 kilograms of HALEU. This delivery to the DOE completed Phase II of Centrus' contract.

Image source: Centrus Energy.

Now, Centrus has moved into Phase III, which includes another 900 kilogram delivery and options for another additional eight years of production post-2026.

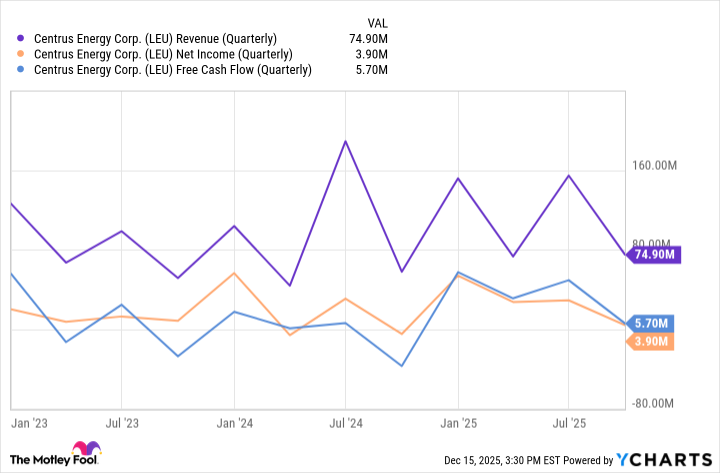

In December 2025, Centrus also announced it had started work on new infrastructure at the Piketon facility, which will help it expand its uranium enrichment capacity. The company also posted a third-quarter profit of about $4 million on roughly $75 million in revenue.

The stock may be volatile, but the company is still executing on key deliveries and laying the groundwork for expansion. It's not a safe stock but may be worth watching.