If you invest long enough, you'll find that companies often go through bouts of adversity, sometimes for years at a time. That's precisely what has happened to Clorox (CLX 1.09%).

The stock was red-hot during the pandemic, which spiked demand for its products. Unfortunately, one issue after another has plagued the company since then. The legendary dividend stock has fallen nearly 60% from its high, last seen several years back.

I don't blame anyone who hesitates to invest in a stock that's been in a multiyear decline. No stock falls like that without some genuine problems.

Yet, I would buy Clorox right now without a second thought. Here's why its struggles could end sooner rather than later.

Image source: Getty Images.

The stock hasn't been performing well. Here's why.

It's worth spending a moment to first unpack what has ailed Clorox in the first place. The reality is that it hasn't been one single problem, but a handful of them.

When Clorox's bleach and other cleaning products flew off the shelf during the pandemic, the company had to invest heavily to increase its production capacity. Inflation surged shortly after the pandemic, which put added pressure on profit margins. That was something many companies had to deal with.

But it doesn't end there. A severe cyberattack in 2023 disrupted operations, costing the company an estimated $380 million.

Lastly, Clorox formally transitioned to a new enterprise resource planning (ERP) software earlier this year, modernizing its operations after using outdated programs that were decades old. While modernizing software is beneficial in the long run, these transitions are often disruptive and cumbersome.

The cumulative impact of all of these issues? Revenue slumped, and earnings plummeted.

Concrete evidence that Clorox is still a fantastic business

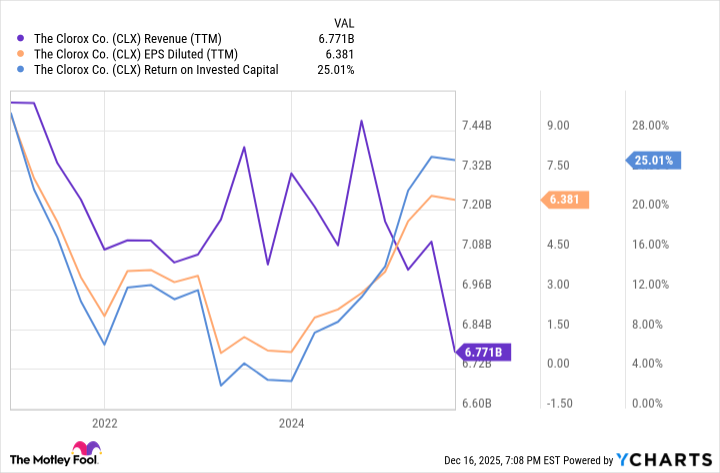

The chart below illustrates the fallout. Earnings have yet to recover to their peak, but Clorox's revenue and profits have shown clear improvement since 2024. Perhaps the most encouraging sign for long-term investors is the company's strong rebound in its ROIC, or return on invested capital.

Data by YCharts; TTM = trailing 12 months.

This metric essentially measures how efficiently the business makes money. In other words, you put a dollar in, and you get more money out. Clorox's current ROIC of 25% aligns with its pre-pandemic performance.

A high ROIC is also an indicator of a company's competitive moat. Clorox makes bleach and other cleaning products, as well as various niche household brands, including Liquid-Plumr drain cleaner, Pine-Sol, Fresh Step cat litter, Glad plastic bags, Hidden Valley Ranch dressings, Kingsford charcoal, Brita water filters, and Burt's Bees personal-care products.

There isn't much proprietary about bleach or charcoal, but the company's product innovation and brand reputation tend to win consumers over from competing and generic alternatives. Clorox's rebound, led by its surging ROIC, is a good indicator that the company still has its secret sauce, despite the poor business and investment results in recent years.

A generous dividend and a cheap valuation

If you're looking for another clue on Clorox's durability, look at the crown atop its head. It's a Dividend King -- i.e., a company with at least 50 consecutive annual dividend raises. Due to the stock's slump, the current dividend yield is almost 5%, its highest ever.

Abnormally high yields are often yield traps -- lousy stocks that lure you in with unsustainable dividends. That's not Clorox. Analysts expect earnings per share to grow substantially as the business rebounds following its ERP transition.

The dividend payout ratio is 72% of next year's earnings estimates, which should be manageable given its strong balance sheet (investment-grade credit) as a financial buffer. Management is targeting 3% to 5% annual sales growth, which is plenty to grow the dividend for a company with such a high ROIC.

NYSE: CLX

Key Data Points

Clorox's price-to-earnings ratio is less than 15, a dirt-cheap valuation that should fully reflect all the recent woes. Investors who buy and hold the stock can enjoy the dividend while waiting for the company to regain the market's trust. Once it does, the stock could easily see higher valuations, making it a potential dividend and capital gains dynamo if things go as hoped.

That promise, combined with the durability of a proven Dividend King, makes Clorox a no-brainer buy right now.