Alphabet (GOOG +1.91%) (GOOGL +1.88%) has been one of the top-performing stocks in the whole market in 2025. Its stock has risen over 60%, placing it in the top 30 performers of the S&P 500 in 2025. While the top 30 may not be as impressive as the top 10, investors must realize that Alphabet's size makes this feat all the more impressive.

Alphabet experienced several tailwinds in 2025 that brought its stock price to far below average to in line with its peers. This growth was aided by a positive ruling in its monopoly court case and Alphabet emerging as a leader in the generative AI realm. Those catalysts are gone for 2026, and investors need new reasons for why Alphabet's stock could soar next year.

I've got three reasons why it will be a successful investment, and one reason it may be time to move on. But is that one reason to sell enough to outweigh the three reasons to buy? Let's find out.

Image source: Getty Images.

1. Alphabet's core business is excelling

Alphabet has a ton of business units under its umbrella, but none is more important than its core business: Google Search.

Earlier this year, investors were worried that Google Search may be going away as generative AI was in a position to replace it. However, that hasn't panned out, largely thanks to the integration of AI search overviews, which provide a hybrid generative AI and traditional search experience. This has allowed Google to maintain its market position and thrive in a booming ad market.

In Q3, Google Search revenue rose 15% year over year, not bad for a mature business unit that's expected to grow in the high single digits to the low double digits. When Alphabet's base business thrives, so does the rest of the company. If Google Search can keep delivering strong results throughout 2026, Alphabet stock will be a great one to own.

NASDAQ: GOOGL

Key Data Points

2. Google Cloud is thriving in the AI buildout

Another area of its business that's doing quite well is its cloud computing wing, Google Cloud. Cloud computing is thriving for two reasons.

First, traditional workloads are migrating to the cloud because it's much easier than maintaining expensive equipment and computing hardware on-site. Second, artificial intelligence workloads are rapidly coming online, and most companies don't have the resources to build their own giant data center, so they rent computing capacity from a provider like Google Cloud.

In Q3, Google Cloud's revenue rose 34% year over year. That's one of Alphabet's fastest-growing segments, and investors shouldn't be surprised to see this growth rate continue throughout 2026.

3. Alphabet may have a new business unit launching

Part of the reason Alphabet's cloud computing business has been so successful is its custom AI chips, Tensor Processing Units (TPUs). TPUs are an alternative to graphics processing units (GPUs) and are suited for specific workloads more than GPUs. This allows them to deliver better performance at a lower cost when running specific workloads, making them a popular option.

Currently, clients can only gain access to them by renting them through Google Cloud. But that could be changing. Reportedly, Alphabet is in talks with Meta Platforms to sell TPUs outright, which could be a brand-new business unit starting up. That's a revenue stream that investors haven't accounted for, making Alphabet an intriguing stock for 2026.

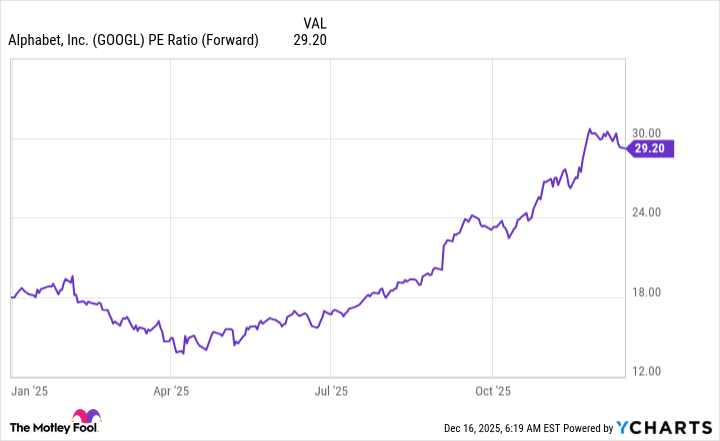

Alphabet's stock isn't as cheap as it once was

After its strong run in 2025, Alphabet's stock is no longer cheap. It now trades for nearly 30 times forward earnings, which isn't a historically cheap price tag for any stock.

GOOGL PE Ratio (Forward) data by YCharts

This may hamper Alphabet's long-term returns, but only if the market deems the stock too expensive. Many of Alphabet's big tech peers have traded around this valuation level for an extended time period, so it isn't unrealistic to assume that Alphabet can maintain this premium.

If it can, Alphabet will be a top stock to own for 2025. If it can't, it could be a rough year.