The S&P 500 (^GSPC +0.76%) recently reached a new all-time high, and many investors are optimistic about the future -- with more than 44% of U.S. investors feeling "bullish" about the next six months, according to the most recent weekly survey from the American Association of Individual Investors.

As we head into 2026, now is a smart time to take stock of your portfolio and adjust your strategy as needed. While everyone's investing approach may differ, there's one move that could help you earn far more in 2026 and beyond.

Image source: Getty Images.

The power of consistency

With the market reaching new heights, some investors are hesitant to buy at record prices. That's understandable, considering right now is an incredibly expensive time to invest. However, waiting for a more affordable moment to buy could end up being even more costly.

Nobody knows what the stock market will do in the near term. It could take a turn for the worse tomorrow, or prices could continue surging for another year. And sometimes, even the experts get it wrong.

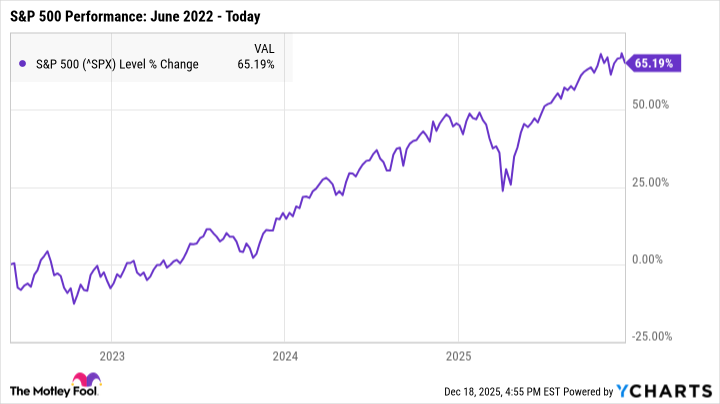

For example, back in June 2022, analysts at Deutsche Bank predicted that there was a "near 100%" chance that U.S. economy would fall into a recession within a year. However, by the end of 2023, the S&P 500 had soared by more than 16%. By today, the index is up by more than 65%.

If you'd stopped investing in mid-2022 out of concern that a downturn was looming, you'd have missed out on significant potential earnings.

One of the best investing moves you can make in 2026, then, is to continue investing consistently -- no matter what the market does. Prices could take a turn for the worse, but given enough time, the market will recover. And if stocks continue to surge, you'll be prepared to capitalize on those gains.

A long-term outlook can keep your money safer

Eventually, the market is bound to face another downturn. Stocks can't keep climbing forever, and the next bear market or recession will hit at some point. But by staying in the market for the long haul, you're far more likely to come out the other side unscathed.

For instance, in December 2007, the S&P 500 began its descent into the Great Recession. The market wouldn't begin recovering until mid-2009, and it took several more years for the S&P 500 to reach a new all-time high. Yet by December 2017, the index had soared by more than 80%.

In other words, even if you'd invested at the worst possible moment -- at record high prices immediately before one of the worst recessions in U.S. history -- you'd still have nearly doubled your money within a decade.

The key, however, is to invest in the right places. Shaky stocks will struggle to recover from market downturns, while those with solid foundations are far more likely to bounce back and experience long-term growth.

Right now is one of the best times to review your portfolio and ensure that every investment is still worthy of being there. If you find any stocks that are no longer strong investments or don't align with your goals, selling them while the market is still thriving is a smart move.

The future of the market may be uncertain, but that doesn't need to affect your strategy. By consistently investing in strong stocks and staying in the market for at least a decade or so, you're far more likely to see long-term growth -- regardless of what may happen in 2026.