The market is currently pivoting toward a risk-off approach to artificial intelligence (AI) and stocks in adjacent tech areas such as quantum computing. As a result, many quantum computing pure plays have sold off. However, that hasn't affected my top quantum computing stock pick for December: Alphabet (GOOG +1.83%) (GOOGL +1.88%)

While the tech giant doesn't have the upside potential of the smaller quantum computing players, it is far steadier. Furthermore, it has resources that its competitors can only dream of.

Image source: Getty Images.

Alphabet has proven its quantum computing prowess

The smaller quantum computing companies are all-in on the technology, and if they don't succeed in producing systems that attract a significant customer base, they're likely to go to $0. Many of them will fail.

Alphabet, by contrast, doesn't need its quantum computing endeavors to succeed. It's developing the technology for in-house use and to rent access to through Google Cloud. But Alphabet is already spending tens of billions of dollars annually on hardware for its cloud and AI infrastructure. Anything it can do to reduce its input costs for future computing resources is a smart move.

It has already done this in the AI accelerator segment, developing a family of application-specific integrated chips it calls Tensor Processing Units (TPU) in conjunction with Broadcom. This has given Alphabet some experience in developing custom computing hardware.

NASDAQ: GOOGL

Key Data Points

Alphabet's quantum computing chip, Willow, has already made waves in the industry. In October, it announced that a Willow chip ran an algorithm that, for the first time ever, demonstrated a verifiable quantum advantage. Its quantum computer ran that algorithm 13,000 times faster than the world's fastest supercomputer could have.

This was a huge step toward commercial viability for Alphabet's quantum computing hardware, and investors shouldn't be surprised if the company announces further milestone achievements in 2026. Yet unlike its smaller quantum computing competitors, Alphabet doesn't need to trumpet every little breakthrough because it is self-funding its research. The pre-earnings start-ups, by contrast, need publicity to help them attract money from research partners and the public markets to stay alive.

Because it has no need to please researchers or impress shareholders with its quantum computing progress in particular, Alphabet is free to pursue its own path with the technology. That's a huge advantage.

Alphabet has resources its competitors can only dream of

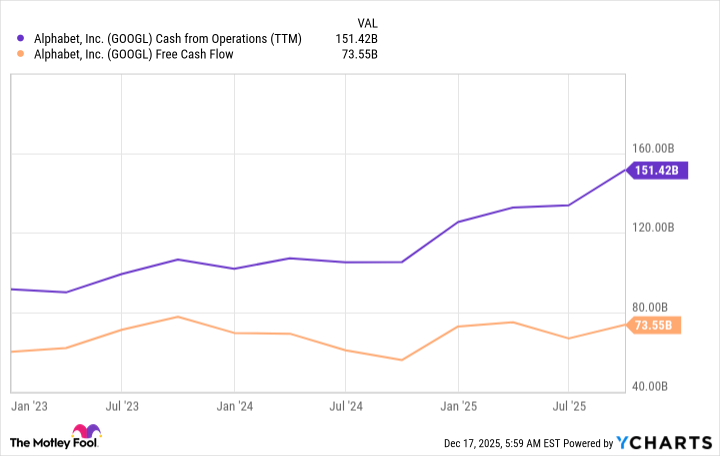

Another reason why Alphabet is my top quantum computing stock now is that its business already produces enormous quantities of cash that it can plow into whatever growth avenues it chooses. Currently, a lot of that money is being spent to construct data centers for AI computing, but if quantum computing turns out to be all that it has been hyped up to be, Alphabet could easily devote a large chunk of its cash flow toward advancing its position in that technology.

The two metrics that investors should pay attention to on that front are operating cash flow and free cash flow. Operating cash flow is the total amount that the business generates from operations, while free cash flow measures what's left after it covers obligations such as interest expenses and taxes, and also capital expenditures. While a vast amount of Alphabet's cash flows are going toward its data center buildouts, it still has plenty available to devote to other ambitions such as quantum computing.

GOOGL Cash from Operations (TTM) data by YCharts.

For Alphabet, it wouldn't be a stretch to throw $10 billion at its quantum computing unit, but it's a sum that the pure plays could only dream of. Because of its superior resources and the achievements it has already made in the space, I think it will be a force to be reckoned with by the time useful quantum computing comes to market. It also isn't a boom-or-bust investment, making it a far safer stock to own than its smaller quantum computing competitors.