If you have $1,000 available to invest today, one of the best ways to make the market work for you is investing in an exchange-traded fund (ETF). If you can hold for the long term, you can take advantage of the powerful effects of market gains compounding over time.

Even if you have a complete portfolio of single stocks, ETFs can provide extra diversification to minimize risk. The Vanguard S&P 500 ETF (VOO +0.89%) and the Vanguard Information Technology ETF (VGT +2.02%) are two excellent choices to buy with now and hold for the long term.

Image source: Getty Images.

1. The S&P 500 ETF

The S&P 500 is an index of about 500 of the largest companies in the U.S. These days, it's synonymous with "the market," since it provides an easily trackable base, going back decades, of many of the best stocks on the market. The Vanguard ETF is an index fund, which means that it simply tracks the index, owning the same stocks and moving along with it. Since the index switches out stocks that might be lagging when they dip below the threshold of inclusion, the index and ETF, by default, are growth-oriented.

Since it's a passive index fund, and it isn't actively managed, it doesn't come with hefty management fees. It has a low expense ratio of 0.03%, which it says is in contrast with 0.73% for comparable ETFs.

The largest holdings in the ETF are the largest holdings in the S&P 500, and since it's a weighted index, these stocks account for a large percentage of the total. Nvidia, Apple, and Microsoft together represent moren than 20% of the entire fud.

As most investors know, it's not easy to beat the market. The S&P 500 has returned an annualized average of 14.6% over the past 10 years, which is an excellent result. Even if you also have an individual stock portfolio, owning an S&P 500 ETF is a secure growth machine for the long-term investor.

2. The Information Technology ETF

If you typically stick to the S&P 500 and you want to give your portfolio a boost, the Information Technology ETF is an excellent choice. It's also an index fund, and it has 322 components today. That's not quite as many as the S&P 500, but it's still strong diversification. While it tends to own high-growth tech stocks, which may be riskier than value stocks in the S&P 500, the risk is mitigated by the number of components.

It has the same three top stocks as the S&P 500 ETF, since they're all tech stocks, but the account for 44% of the total. Its next three largest components are Broadcom, Palantir Technologies, and Advanced Micro Devices. Most of the other 300 or so stocks in the ETF are small positions, but the ETF provides broad exposure to amny different trends in tech.

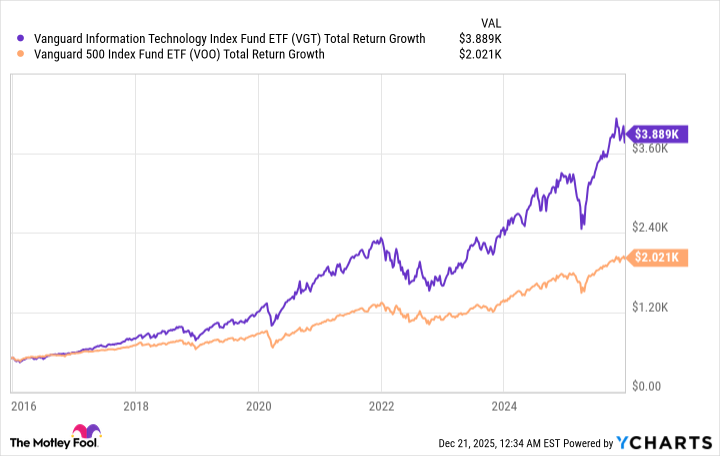

Since it targets strong growth, this ETF tends to outdo the broader market when the market is going up. And since there are more bull markets than bear markets, this ETF has outperformed the S&P 500 over time. It's up 22% this year, and it has delivered an annualized return of 22% over the past 10 years, the highest annualized gain of any Vanguard ETF over the past decade. If you had invested $1,000 in this ETF 10 years ago, you'd have nearly double your gain of investing in the S&P 500 ETF.

VGT Total Return Level data by YCharts

This is an excellent way to benefit from market growth while minimizing the risk of concentrating your holdings in a just a few stocks. It's not for the most risk-averse investor, but if you have $1,000 to invest today and can hold the ETF for many years, it should reward you well over time.