Artificial intelligence (AI) stocks have helped investors take major steps along the path to wealth in recent years. Investors placed bets on the potential for this hot technology to revamp the way many things are done -- and as a result, supercharge the growth of companies.

Two players in particular have attracted investors’ attention, and they are Palantir Technologies (PLTR +5.46%) and Nvidia (NVDA +2.34%). The former is a software company that’s helping its customers harness the power of AI, and the latter is the world’s leading AI chip designer. Both of these companies have seen earnings soar in recent years, and the stock prices have followed. Over the past three years, Palantir stock has jumped 2,400% and Nvidia has advanced more than 900%.

Both of these tech companies are well-positioned to benefit as this AI story continues to unfold, making them great stocks to own. But which one is the best AI stock to buy now? Let’s find out.

Image source: Getty Images.

The case for Palantir

Palantir has been around for more than 20 years, but the AI boom represented a real turning point. The company, throughout most of its history, relied on government contracts for steady growth, but in recent times, demand from commercial customers has taken off. This is thanks to Palantir’s focus on AI. The company launched its AI-driven product, Artificial Intelligence Platform (AIP), two years ago, offering customers a way to immediately apply AI to their needs.

AIP helps customers aggregate their data and use it in various ways -- this could involve making decisions, developing new ways of operating, and more. Demand has been high among both government and commercial customers, leading to revenue growth in the double digits for each business. Commercial customer count, contract value, and overall profit also have been on the rise -- and the company has continued to increase full-year guidance.

The AI market is forecast to reach into the trillions of dollars in a few years, and Palantir is well-positioned to benefit -- that’s because this company makes it easy for customers to get in on AI while barely lifting a finger.

NASDAQ: PLTR

Key Data Points

The case for Nvidia

When you think of AI, you probably immediately think of Nvidia. That’s because this company has built an AI fortress over the past few years -- it’s not only the leading AI chip designer, but it also offers a wide range of related products and services for every AI need.

All of this has helped Nvidia generate double- and triple-digit earnings growth in recent quarters and years -- with revenue and net income reaching record levels. In the latest full year, Nvidia’s revenue soared in the triple digits to more than $130 billion.

The company has committed to updating its famous chips, or graphics processing units (GPUs), on an annual basis, a move that should keep it ahead of rivals. And demand for its latest releases has been spectacular -- we saw this with the release of the Blackwell architecture about a year ago and the launch of update Blackwell Ultra a few months ago.

Nvidia predicts that AI infrastructure spending could reach as much as $4 trillion by the end of the decade. The company could be a big winner in such a story because, as data centers build out, they need high-powered chips.

NASDAQ: NVDA

Key Data Points

Palantir or Nvidia?

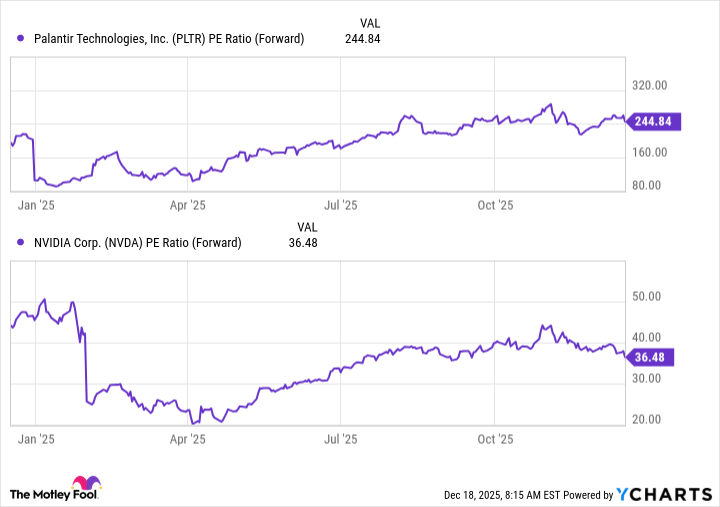

Before we answer the question, let’s take a look at valuation. In the case of Palantir, it’s been extremely high for quite some time, but it’s important to remember that the company is in the early days of its growth story -- and this metric only considers earnings estimates a year from now and not farther down the road.

In Nvidia’s case, we can more easily look at valuation and see that there is a window of opportunity here. The stock is trading for 36x forward earnings estimates, down from as much as 50x a year ago.

Meanwhile, as mentioned, Nvidia is particularly well placed to benefit from AI infrastructure spending.

So, right now, Palantir is a solid stock to buy and own -- but Nvidia, for the dip in valuation and upcoming AI infrastructure opportunity, is the best stock to buy now.