Palantir (PLTR +5.59%) has been an exceptional stock pick over the past three years. In 2023, the stock rose 167%, in 2024 it was up 341%, and so far in 2025, it's up around 140%. Finding a stock that can double in one year isn't an easy task, but finding a stock that repeats that feat for three years in a row is practically unheard of.

Can Palantir repeat this feat in 2026? Or is it due for a moderate year? Let's take a look and see if the company is a top stock pick again in 2026.

Image source: Getty Images.

Palantir's AI software is growing in popularity

Palantir makes artificial intelligence-powered data analytics software. It was originally designed for government use, but eventually found widespread adoption in the commercial sector. There's a huge appetite for software that can boost productivity via AI, and this company is one of the best in this realm.

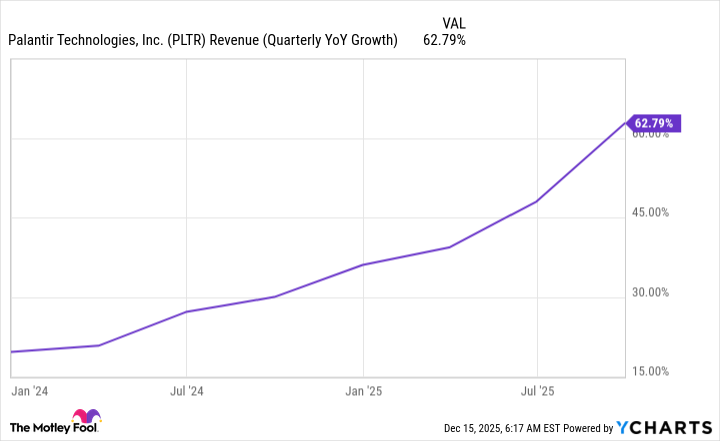

A huge selling point for Palantir is its AIP add-on, which incorporates generative AI into the platform. This allows different levels of automation, ranging from full AI control to AI processing, but with human approval. The results have been fantastic, and its revenue growth continues to accelerate quarter after quarter.

In Q3, Palantir's revenue rose 63%. That's an acceleration over the previous quarter, continuing a trend that has persisted since 2024.

PLTR Revenue (Quarterly YoY Growth) data by YCharts

Palantir is seeing strength from both government and commercial clients. Government revenue was the largest, growing at a 55% pace to $633 million, while commercial growth was 73% to $548 million. Both growth rates are nothing short of incredible, but the company still has a decent runway.

In the U.S. commercial customer realm, Palantir has 530 clients. That leaves plenty of other businesses to capture, fueling its growth case. However, the company won't be able to grow at this pace forever, and that could be a problem for the expectations baked into its stock.

Palantir's stock has become far too expensive

Since 2023, its stock has risen by over 2,700%. If you had to guess how much its revenue has grown by since then, you might guess in the 1,000% or greater range. However, it's only up 104% since the start of 2023.

NASDAQ: PLTR

Key Data Points

That means the bulk of Palantir's stock price growth has come from multiple expansion, which occurs when investors are willing to pay more for a stock than they used to. This isn't a phenomenon isolated to this company, as many other stocks have seen this occur. However, the degree to which Palantir's stock has experienced this is unheard of.

Most software stocks trade from 10 to 20 times sales, with the best maybe getting a valuation of 30 times sales. However, Palantir is nowhere near this level.

PLTR PS Ratio data by YCharts

At 120 times sales and 254 times forward earnings, Palantir is one of the most, if not the most expensive stock in the market, especially for its size. There are a ton of expectations baked into its stock price, and it may not be able to live up to those. A far more reasonable stock price would be 50 times forward earnings. At its current 40% profit margin, that would translate into a forward price-to-sales valuation of 20.

For Palantir to reach a 50 times forward earnings level from today's 254 times forward earnings valuation would require its earnings to grow 5x. That's no easy feat, and if the company can continue growing its revenue at a 60% pace, it would take about three years' worth of growth to bring it to this far more reasonable valuation point.

The problem is, Wall Street analysts expect Palantir's growth rate to slow in 2026, with the average estimate indicating 41% growth. That stretches this three-year time frame out even longer, further stacking the odds against it.

I think 2026 will be a moderate to down year for Palantir's stock as it has grown too quickly, too fast. A pullback could happen quickly, and investors are best to steer clear of its high valuation.