As the stock market closes out another record-breaking year, many investors have mixed feelings about what lies ahead.

Around 80% of Americans are at least slightly concerned about the potential for a recession, according to a December report from financial association MDRT. At the same time, though, around 44% of U.S. investors feel optimistic about the future of the market, according to the most recent weekly survey from the American Association of Individual Investors.

It's normal to feel conflicted about the future, as nobody knows where the market is headed. The last few years of record-breaking growth have been exciting for investors, but eventually, stock prices are bound to fall. So is that downturn coming in 2026? History has both good and not-so-good news.

Image source: Getty Images.

First, the bad news

To be clear, nobody can say exactly what the market will do in the short term. But some stock market indicators suggest that a downturn could be looming.

Take, for example, the ratio of the U.S. stock market's total market cap to the gross domestic product (GDP) -- nicknamed the Buffett indicator. In 2001, Warren Buffett told Fortune magazine that he'd used this indicator to correctly predict the onset of the tech bubble burst in the late 1990s.

"For me, the message of the chart is this: If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you," he explained. "If the ratio approaches 200% -- as it did in 1999 and a part of 2000 -- you are playing with fire."

As of this writing, the Buffett indicator is at its highest level ever, nearly 234%. According to Buffett, this suggests the market is significantly overvalued.

Keep in mind, though, that no stock market indicator is perfect. A lot has changed since Buffett made his previous prediction, and as company valuations naturally increase over time, the Buffett indicator may become less reliable.

The silver lining for investors

We may or may not face a bear market, recession, or correction in 2026. However, even if the market experiences a significant downturn, its long-term future remains incredibly bright.

Over time, the market is almost certain to recover from periods of volatility. It can sometimes take years for stock prices to begin reaching new highs again, but if history tells us anything, it's that investors who maintain a long-term outlook can earn the most in the stock market.

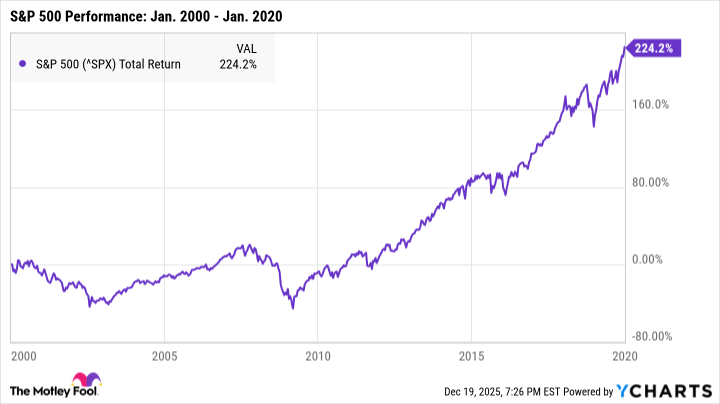

For example, say you were investing in the stock market in the early 2000s, immediately before stocks fell into a prolonged bear market when the dot-com bubble burst. After the S&P 500 reached a new high, officially entering a new bull market, it almost immediately sank into the Great Recession.

Those first few years of the 2000s would have been rough, without a doubt. But after 20 years, the S&P 500 had earned total returns of 224%. In other words, despite facing two of the worst bear markets in U.S. history, investors could have more than tripled their money in the S&P 500 in those two decades.

The stock market's ability to recover from downturns isn't anything new, either. Throughout the S&P 500's history, there's never been a single 20-year period in which the index earned negative total returns, according to analysis from Crestmont Research. This means that if you'd invested in an S&P 500–tracking fund at any point and held it for 20 years, you'd have made money.

It's unclear what the market will do in 2026, but even if we face the worst-case scenario of a deep recession, time is your best asset as an investor. By investing in quality stocks and holding them for at least a decade or so, you make it very likely that your portfolio will thrive no matter what the market does.