Nvidia (NVDA +1.29%) stock has made investors significantly richer in the past five years. An investment of just $100 made in the shares of this semiconductor giant five years ago is now worth $1,360.

Nvidia’s remarkable gains have been fueled by the terrific demand for the company’s artificial intelligence (AI) chips. It is now the world’s largest company with a market cap of just over $4.4 trillion. As such, it would be difficult for Nvidia to replicate its remarkable gains in the next five years.

Its massive market cap, premium valuation, and the rising competition in the AI chip market could weigh on its stock market performance through 2030, even though there is a good chance that it may become a $10 trillion company by the end of the decade. However, there is another semiconductor stock that’s not just extremely cheap right now but is growing at a phenomenal pace.

Micron Technology (MU +1.31%) manufactures memory chips used in data centers, computers, smartphones, and automotive applications. Let’s look at the reasons why this company will outperform Nvidia over the next five years.

Image Source: Micron Technology

Micron Technology is on track to clock stunning growth through 2030

The demand for the memory chips that Micron manufactures is booming, thanks to AI. The high-bandwidth memory (HBM) chips that it makes are deployed in large quantities by companies like Nvidia, AMD, Broadcom, Marvell, and others, to transport massive amounts of data at high speeds at lower power consumption and low latency to enable AI workloads in data centers.

NASDAQ: MU

Key Data Points

Additionally, edge AI devices such as smartphones and computers are now requiring higher dynamic random-access memory (DRAM) and storage to run AI workloads locally. The AI-fueled demand for memory is so strong that there is a shortage of these chips, leading to an increase in prices.

This explains why Micron’s latest results for the first quarter of fiscal 2026 (which ended on Nov. 27) blew past expectations. The stock rose 8% in extended trading after reporting on Dec. 17. That wasn’t surprising as Micron’s revenue shot up 57% year over year to $13.6 billion, while non-GAAP earnings jumped by a whopping 167% to $4.78 per share.

The company’s cloud memory business nearly doubled year over year to $5.3 billion, driven by AI, allowing Micron to crush Wall Street’s expectations. The guidance was the icing on the cake. Micron expects its fiscal Q2 revenue to jump by 2.3x year over year in the current quarter to $18.7 billion. Non-GAAP earnings are projected to increase by a massive 440% to $8.42 per share.

The estimates are well above Wall Street’s revenue estimate of $14.2 billion and earnings expectation of $4.78 per share. Micron CEO Sanjay Mehrotra remarked on the latest earnings call that the “growth in AI data center capacity is driving a significant increase in demand for high-performance and high-capacity memory and storage.”

Micron has raised its server growth forecast for 2025 to a high teens percentage range, up from the prior expectation of 10%. It expects the server market to keep growing in 2026, a trend that’s likely to last through 2030. Market research firm IDC expects global AI infrastructure spending to hit $758 billion in 2029. Accelerated servers that support AI workloads are expected to clock a 42% annual growth rate through the end of this period.

Not surprisingly, Micron’s competitor SK Hynix is estimating a 30% annual increase in the AI memory market through the end of the decade. However, that number could be higher as even custom AI chipmakers are now deploying HBM to make their chips faster and more efficient. Micron, for instance, expects the HBM market to grow at a 40% annual rate through 2028, generating $100 billion in revenue after three years, as compared to $35 billion this year.

As such, there is a strong possibility that Micron will maintain its healthy growth levels through 2030. Throw in the company’s attractive valuation, and it is easy to see why this AI stock is poised to outperform Nvidia through 2030.

Here’s how much upside investors can expect

Micron stock is significantly undervalued in relation to the potential growth it can deliver over the next five years. This is evident from the stock’s price/earnings-to-growth ratio (PEG ratio) of just 0.53, as per Yahoo! Finance. This multiple is calculated by dividing a company’s trailing earnings multiple by the annual earnings growth that it is projected to clock over the next five years. A reading of less than 1 means that a stock is undervalued, and Micron is way below that threshold.

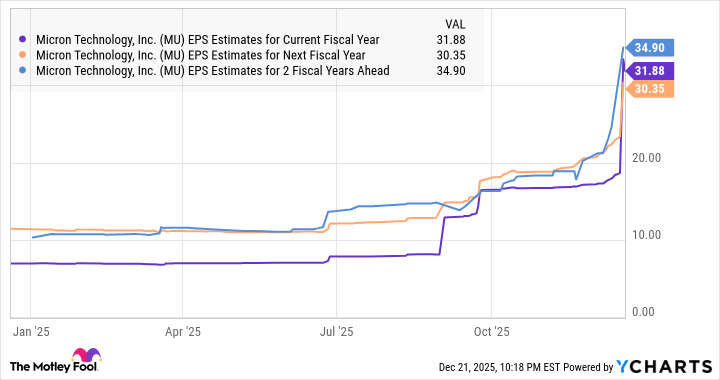

Nvidia, meanwhile, has a PEG ratio of 0.69, suggesting that Micron is the better growth stock of the two. Moreover, analysts have significantly raised their earnings growth expectations for the next couple of years.

MU EPS Estimates for Current Fiscal Year data by YCharts

Assuming Micron can increase its earnings by a highly conservative rate of just 10% in fiscal years 2029 and 2030, its bottom line could jump to almost $42.23 per share after five years (using the fiscal 2028 estimate of $34.90 per share seen above as the base). If Micron trades at even 25 times forward earnings at that time (in line with the Nasdaq-100 index’s forward earnings multiple), its stock price could hit $872 in 2030.

That would be more than triple its current stock price. However, bigger gains cannot be ruled out as Micron’s rapid growth could be rewarded with a higher multiple in the future, which means that it could indeed run circles around Nvidia through 2030.