The semiconductor industry experienced stellar growth in 2025. Data compiled by the World Semiconductor Trade Statistics (WSTS) organization suggests that semiconductor sales are on track to increase by 22.5% this year to just over $772 billion.

Not surprisingly, semiconductor stocks have registered solid gains this year, as evident from the 42% jump in the PHLX Semiconductor Sector index. The good news is that the industry’s growth is poised to accelerate in 2026, with revenue poised to jump by 26.3% to $975.4 billion.

That’s why now would be a good time to take a look at some of the top names in this industry that could deliver terrific gains to investors in the new year.

Image Source: ASML

The semiconductor industry’s secular growth should supercharge these stocks

The semiconductor industry is approaching the $1 trillion revenue milestone much earlier than the prior timeline of 2030. This isn’t surprising, as semiconductors play a critical role in the proliferation of artificial intelligence (AI) across various verticals, including data centers, smartphones, computers, and factories.

Taiwan Semiconductor Manufacturing (TSM +1.50%), popularly known as TSMC, is one of the best ways to capitalize on the secular growth of the semiconductor market in 2026. After all, it is the world’s largest foundry with a market share of 72% at the end of the previous quarter, according to Counterpoint Research. What’s worth noting is that TSMC’s share of the foundry market improved by six percentage points year over year last quarter, as all the top chip designers have been rushing to manufacture chips on its advanced nodes.

NYSE: TSM

Key Data Points

The chips fabricated by TSMC for customers such as Nvidia (NVDA +3.93%), AMD, Apple, Broadcom, Qualcomm, and others, go into all the verticals of the semiconductor industry. This is the reason why the company’s growth has been outstanding this year. Analysts are expecting the company to end 2025 with a 30% jump in revenue, while the bottom line is anticipated to increase by almost 48% to $10.41 per share.

There is ample evidence suggesting that TSMC’s growth could accelerate next year. For instance, TSMC’s production capacity of the advanced 2-nanometer (nm) node that will go into production in 2026 is anticipated to double. What’s more, TSMC has reportedly sold out its entire 2nm production capacity for 2026.

Additionally, TSMC’s 2nm node is reportedly going to be priced at a premium of 10% to 20% over its current flagship -- the 3nm node. As a result, don’t be surprised to see TSMC easily exceeding the 20% earnings growth that analysts are forecasting for 2026, putting the company on track to clock even bigger gains following its 44% jump in 2025.

The fact that TSMC trades at 30 times earnings also helps, as it represents a discount to the tech-laden Nasdaq-100 index’s earnings multiple of 32 (using the index as a proxy for tech stocks). The faster-than-anticipated earnings growth that it may deliver in 2026 could be rewarded with a higher earnings multiple, setting the stock up for massive gains.

ASML Holding (ASML +1.82%) is another company that’s likely to step on the gas in 2026. Shares of the Dutch semiconductor equipment giant are up nearly 50% in 2025. The larger increase in semiconductor sales next year should be a tailwind for ASML, as it manufactures the equipment that enables companies like TSMC to produce advanced chips.

The fact that TSMC has already sold out its 2nm capacity is good news for ASML. TSMC utilizes ASML's advanced equipment to manufacture 2nm chips for customers, so it is likely to place more orders for the latter’s equipment. Not surprisingly, ASML’s outlook for 2026 has improved. Investors should also note that the demand for semiconductor equipment is set to increase over the next couple of years, driven by AI investments.

As a result, ASML’s earnings growth in 2026 could be much higher than the 5% jump that analysts are currently forecasting. For comparison, its earnings are set to jump by 28% in 2025. So, the faster growth in semiconductor sales in 2026 and the favorable outlook of the semiconductor equipment market should ideally help ASML do better next year than its 2025 performance, putting the stock on track to make investors richer in the new year.

AI spending is going to be a boon for these names

AI is going to play a central role in boosting the semiconductor market next year. Bloomberg Intelligence estimates that spending on AI servers could jump by 45% in 2026 to $312 billion. As these servers are equipped with AI chips from companies such as Nvidia (the leader in AI chips), there is a good chance that this AI stock will deliver a solid performance in the new year.

NASDAQ: NVDA

Key Data Points

Nvidia already has a solid backlog of $275 billion in the data center business for next year. Even better, the company’s growth potential for 2026 has received a major shot in the arm following the Trump administration’s announcement that it will be able to sell its advanced chips into the Chinese market. This move could significantly boost Nvidia’s growth next year.

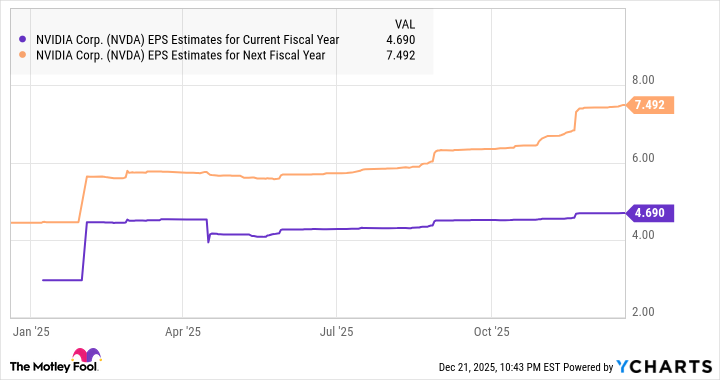

This indicates why analysts have increased their earnings growth expectations for Nvidia in 2026.

NVDA EPS Estimates for Current Fiscal Year data by YCharts

Assuming Nvidia indeed achieves $7.49 per share in earnings next year, as seen in the chart above, and trades at 32 times earnings at that time (in line with the Nasdaq-100 index), its stock price could jump to $240. That suggests a potential jump of 33% from current levels, though don’t be surprised to see this chip giant do better than that as it has the potential to clock a bigger jump in earnings in 2026, thanks to recent developments.