Warren Buffett will step down as Berkshire Hathaway's (BRK.A 0.56%) (BRK.B 0.67%) CEO at year-end. He isn't fully retiring, though. The investing icon will continue to serve as Berkshire's executive chairman.

In his last few days at Berkshire's helm, Buffett is also leaving some subtle and not-so-subtle warnings for Wall Street. What are his warnings – and what should investors do as 2026 approaches?

Image source: The Motley Fool.

Buffett's subtle warnings

"The Adventure of Silver Blaze" ranks as one of my favorite short stories written by Sir Arthur Conan Doyle. In this story, Sherlock Holmes solves a mystery by noticing a dog that didn't bark. As he observed, sometimes what isn't done can be important.

I think Buffett's subtle warnings to Wall Street are akin to Doyle's dog that didn't bark. It's wise to pay attention to what the legendary investor isn't doing these days.

In the past, Buffett has been a fan of stock buybacks. He regularly authorized repurchases of Berkshire Hathaway stock. No board approval was required for these buybacks, either. Buffett could repurchase shares at any time he thought the stock was trading below its intrinsic value. However, Berkshire hasn't repurchased shares since the second quarter of 2024.

It isn't just Berkshire Hathaway. Buffett isn't investing heavily in many stocks. He has been a net seller of stocks for 12 consecutive quarters. That's the longest streak where Buffett sold more stocks than he bought in his entire career.

What's Buffett's subtle warning? The stock market is overvalued.

His not-so-subtle warnings

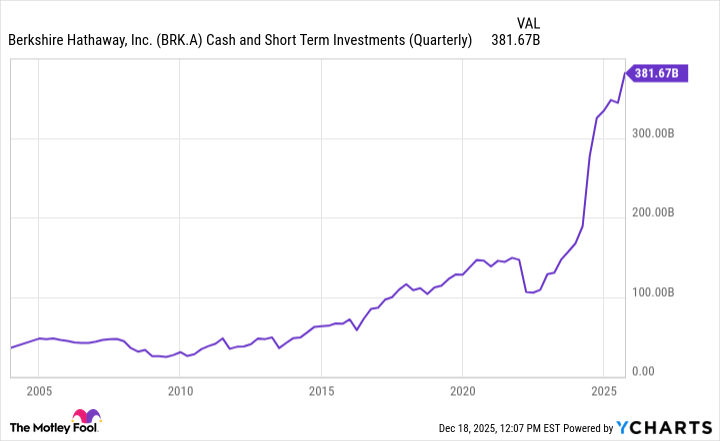

Other Buffett warnings aren't so subtle. Exhibit A is his build-up of a massive cash stockpile for Berkshire Hathaway. At the end of the third quarter of 2025, the conglomerate held roughly $381.7 billion in cash, cash equivalents, and short-term investments in U.S. Treasuries.

BRK.A Cash and Short Term Investments (Quarterly) data by YCharts

As the chart above shows, Berkshire now has a larger cash position than at any point in its history. In fact, no company has ever had as much cash as Berkshire does.

What warning is Buffett sending? It's the same as his subtle warning: The stock market is overvalued. Buffett would prefer to be more heavily invested in equities. He simply can't find enough of them that are valued attractively.

There's also a standing warning the multibillionaire made in the past that shouldn't be ignored.

In 2001, Fortune published an article in which Buffett stated that when the total market capitalization of all publicly traded companies as a percentage of gross national product (GNP) reached an unprecedented level in 2000, it "should have been a very strong warning signal." He added that when this ratio approaches 200%, investors are "playing with fire."

This ratio became known as the Buffett indicator, with gross domestic product (GDP) eventually replacing GNP. Is the Buffett indicator approaching 200% today? Nope. It's significantly higher at 224%. The "Oracle of Omaha" would likely describe this as an emphatic warning to investors.

What should investors do?

None of this means that investors should panic as 2026 draws near. Buffett's subtle and not-so-subtle warnings have been sounding for some time now, but the stock market has continued to climb higher. However, I don't think these warnings should be dismissed, either.

When stock valuations reach frothy levels, a reversion to the mean happens sooner or later. The best way to prepare for this eventuality is to have ample cash ready to invest when stocks trade at a discount. That's what Buffett is doing.

Selling existing positions en masse is usually a bad move, though, even if a market sell-off is on the way. It's next to impossible to perfectly time the market. Buffett still has over $300 billion of Berkshire's money invested in stocks, by the way.

Finally, good stocks trading at attractive valuations can be found even in an overall market that's expensive. While Buffett has been a net seller of stocks over the last three years, he has nonetheless bought several stocks during that period.

Perhaps the best answer to the question about what investors should do in response to Buffett's subtle and not-so-subtle warnings to Wall Street is to simply do what Buffett is doing himself. That approach has worked pretty well for the last six decades.