Investing in a growth ETF can help supercharge your earnings over time. These investments are designed to outperform the market, which could result in earning hundreds of thousands of dollars more than you might with a broad-market fund, such as an S&P 500 ETF.

The Vanguard Growth ETF (VUG +1.38%) is one of the most popular growth funds, but there's one crucial factor to consider before you buy: your investing timeline.

Image source: Getty Images.

A long-term outlook is key

Growth ETFs can be lucrative investments, but they can also experience far more short-term volatility. During market slumps, these ETFs tend to be hit harder than broad-market funds, sometimes even underperforming the market.

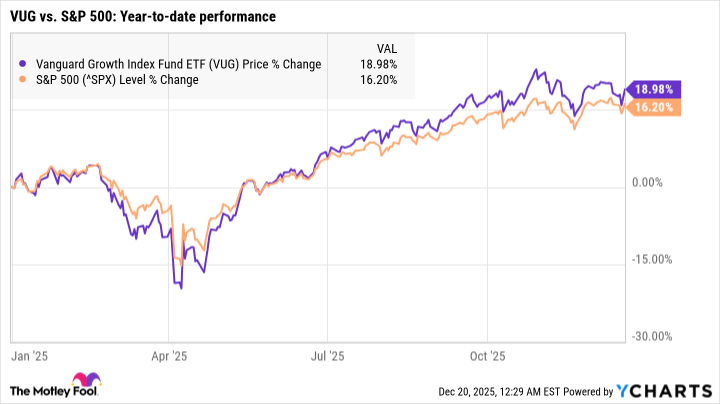

For example, so far this year, the Vanguard Growth ETF has earned total returns of just under 19%, compared to the S&P 500's (^GSPC +0.88%) 16% return during the same period. But when the market plunged earlier this year, the growth fund sank below the index for several months.

The Vanguard Growth ETF is heavily allocated toward tech stocks, which tend to be more volatile in general. During periods of economic instability, they can experience even greater price swings. But given enough time, they often significantly outperform the market.

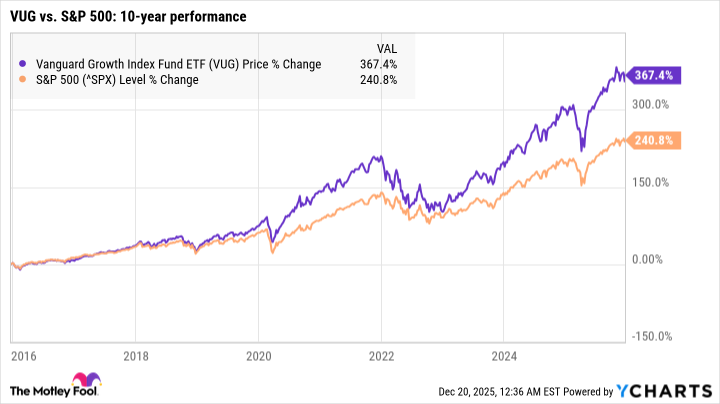

Over the last decade, the Vanguard Growth ETF has earned total returns of more than 367%, while the S&P 500 sits at just under 241% in that time.

The more time you give your investment to grow, the more you can earn. Since its inception in 2004, this ETF has earned an average rate of return of just over 12% per year -- which is higher than the market's historical average of around 10% per year.

At that rate, if you were to invest $200 per month, here's approximately how much you could accumulate over time in both scenarios:

| Number of Years | Total Portfolio Value: S&P 500 ETF Earning 10% Avg. Annual Return | Total Portfolio Value: Growth ETF Earning 12% Avg. Annual Return |

|---|---|---|

| 20 | $137,000 | $173,000 |

| 25 | $236,000 | $320,000 |

| 30 | $395,000 | $579,000 |

| 35 | $650,000 | $1,036,000 |

There's always a chance that the growth ETF could earn even higher returns, too. While the Vanguard Growth ETF's average annual return since 2004 is approximately 12%, its average over the last 10 years is over 17% per year, and its three-year average is nearly 29% per year.

Again, growth funds can be more volatile in the short term, so it's impossible to predict how this ETF will perform over the next few years. But given enough time, there's a good chance that the Vanguard Growth ETF will earn higher-than-average returns -- potentially boosting your earnings by hundreds of thousands of dollars.