Nvidia (NVDA +3.93%) and Palantir (PLTR +4.14%) have been two of the faces of the artificial intelligence (AI) investment trend since it began in 2023. Each has delivered incredible shareholder returns, rising more than 2,600% (Palantir) and nearly 1,100% (Nvidia) since 2023. Each company has also had a phenomenal 2025, with Palantir and Nvidia rising 134% and 27%, respectively.

After those great runs, it wouldn't be a surprise if both of these stocks take a break. However, I think one of them is poised to deliver phenomenal returns in 2026, while the other is set to fall.

Image source: Getty Images.

Each is tackling a different part of the AI realm

Palantir and Nvidia aren't competitors, as they are in completely different parts of the AI world. In fact, they recently teamed up to offer prebuilt models on Nvidia's hardware technologies. Nvidia's contributions to the AI buildout have been its cutting-edge graphics processing units (GPUs). These devices have been the preferred computing unit for nearly every AI hyperscaler due to their incredible power and flexibility. Although other companies are starting to catch up to Nvidia, it's still the leader in AI computing hardware.

Palantir is a software play. Its AI-powered data analytics software platform has delivered valuable insights to clients. Its biggest advancement in the past few years is its AIP platform, which allows clients to make use of generative AI. By deploying AI agents, a company can automate tasks to improve efficiency. This popular product has found adoption by both government and commercial clients.

NASDAQ: PLTR

Key Data Points

Palantir's year-over-year commercial growth for the third quarter was 73%, while the growth of its government division was 55%. Although it grew more slowly, the government division generated $633 million in revenue while the commercial division came in at $548 million. Combined, they delivered 63% growth. That's an impressive quarter for Palantir, but there's a monstrous size difference between it and Nvidia.

Nvidia's Q3 for its fiscal year 2026 (ended Oct. 26) saw similar growth. Its revenue rose 62% year over year, but Nvidia's revenue stream is more than 50 times larger at $57 billion. There's a clear massive demand for AI computing power, and Nvidia is thriving on that. In fact, the company believes that global data center capital expenditures will rise to between $3 trillion and $4 trillion by 2030, up from $600 billion in 2025. The AI buildout is far from over, and both Nvidia and Palantir are slated to deliver further growth.

NASDAQ: NVDA

Key Data Points

With both companies growing at incredible rates, it's hard to determine which is doing better. However, there's another part of the analysis investors must consider.

One company's stock is incredibly overvalued

Finding excellent companies is one part of investing; the other is not overpaying for them. When you compare the valuations of these stocks, it's clear that one is priced far higher.

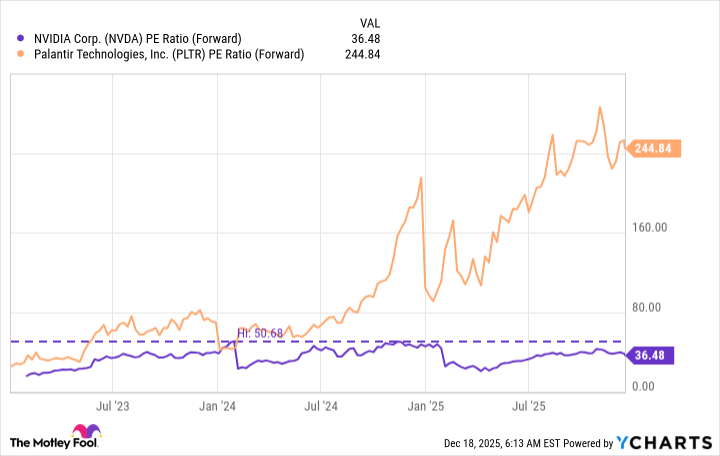

NVDA PE Ratio (Forward) data by YCharts

At nearly 250 times forward earnings, Palantir's stock is nearly 7 times more expensive than Nvidia's. That's a huge problem, as the stock has baked in a ton of growth that must occur over the next few years. Meanwhile, Nvidia's stock may not be cheap by any measure, but if the company can keep up its growth rate, it can easily justify a price tag of 36 times forward earnings.

The reality is that Palantir's stock is likely overvalued and due for a hefty pullback soon. Nvidia's stock has already pulled back from recent highs, and it could be primed to rise in 2026. I think Nvidia is the far better buy here.