As the artificial intelligence (AI) story unfolds, Nvidia (NVDA +3.80%) has so far been the leading character. This is because the company makes the key tool that’s spurred all of the action: AI chips. Nvidia’s graphics processing units (GPUs) fuel critical tasks like the training of AI models so that they later can go on to work for us.

Nvidia’s leadership in the AI chip market and its development of an entire suite of related products and services have helped the company generate record revenue in recent years, with its latest annual sales figure coming in at $130 billion, and the stock price has soared. Over the past three years, Nvidia shares have climbed more than 900%.

But Nvidia isn’t alone in the AI chip market, and a certain rival has made significant progress in recent years. I’m talking about Advanced Micro Devices (AMD +6.15%). The company has put the focus on serving AI, and like Nvidia, has seen its revenue and stock price take off. In fact, right now, AMD actually is more expensive than Nvidia as it trades at a higher valuation. Is it worth the price? Let’s find out.

Image source: Getty Images.

First to market

Nvidia was first to market with its GPUs for AI, and that has helped it build leadership. But in recent years, AMD has prioritized the development of accelerators for AI, and its work is bearing fruit. The company introduced its Instinct GPUs for data centers in late 2016 and has since added to this collection.

Nvidia’s GPUs are known as the fastest around, and the company’s extensive menu of compatible products makes it easy for a Nvidia customer to stick with the company year after year. The market leader has remained a step ahead when it comes to performance, particularly in the area of inferencing, or the powering of AI models as they go through the “thinking” process to solve problems.

NASDAQ: AMD

Key Data Points

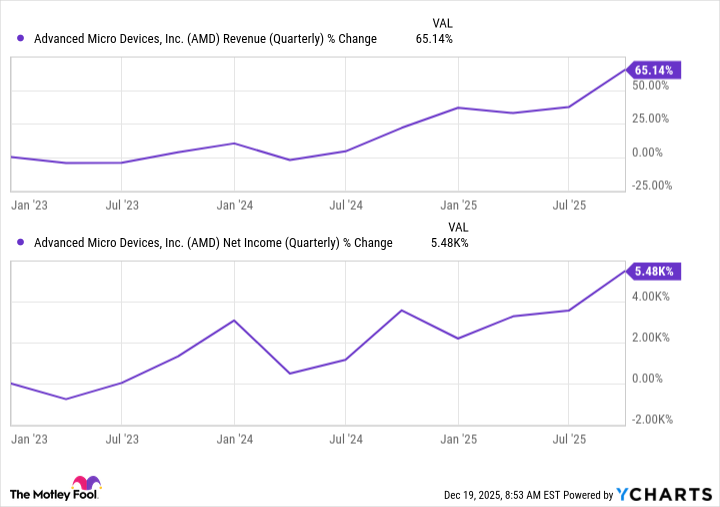

But AMD’s GPUs have delivered growth because they also are very powerful and pricing is competitive. And this has helped supercharge revenue growth. In the recent quarter, revenue climbed 36% to a high of $9.2 billion, thanks to demand for AI processors and accelerators. And the pace of quarterly earnings gains over the past three years offers us reason to be optimistic about AMD’s growth.

AMD Revenue (Quarterly) data by YCharts

Benefiting from infrastructure spending

AMD doesn’t have to unseat Nvidia to succeed in the AI market -- considering Nvidia’s prediction for $3 trillion to $4 trillion in AI infrastructure spending over the coming five years, there’s room for more than one player to win. Data centers often order material from a variety of players, even if they favor Nvidia’s platforms.

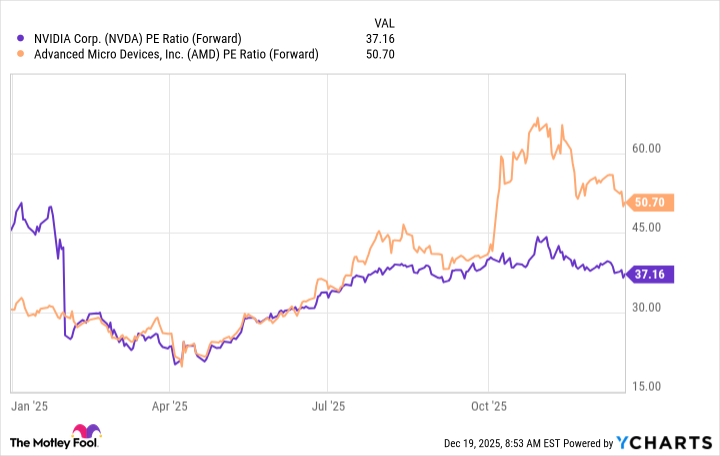

All of this is great news for AMD. But the one element that I’ve looked at with concern in recent months is the stock’s valuation -- particularly in relation to that of Nvidia. Today, trading for more than 50x forward earnings estimates, it’s priced at a premium compared to its bigger rival. As shown in the chart below, Nvidia trades for 37x forward earnings estimates.

NVDA PE Ratio (Forward) data by YCharts

Nvidia’s growth vs AMD’s growth

Meanwhile, Nvidia’s growth has been consistently higher than that of AMD. For example, in the third quarter, Nvidia’s revenue jumped 62% to a record $57 billion. And this showed an acceleration of growth, since Nvidia’s revenue rose 56% in the second quarter. Meanwhile, Nvidia’s plan to update its GPUs on an annual basis should keep growth going -- the company spoke of enormous demand for both its Blackwell and Blackwell Ultra platforms, each released over the past year. Next year, the plan is to launch the Rubin system, and that may be a catalyst for revenue and share price gains.

AMD also continues to innovate, but it may be extremely difficult for the company to step ahead of Nvidia. As I mentioned earlier, the positive point is that the chip designer doesn’t have to beat Nvidia to succeed in this market. And AMD’s revenue trends over the past few years and recent results are fantastic. But I wouldn’t pay more for the company today than I would for Nvidia -- so I would put AMD on my watch list for now and look for opportunities to eventually buy on the dip.