Identifying which artificial intelligence (AI) stock has the most potential in 2026 and beyond is no simple task. If your time frame after 2026 is only a few years, then an AI infrastructure company like Nvidia may be the best option. If your time frame runs for a decade after 2026, you may be better off with a software company like Palantir.

However, if you're looking for a combination of these two options, Alphabet (GOOG +1.60%) (GOOGL +1.47%) is one of the best AI stocks to buy and hold.

Alphabet has had a stellar year, rising around 60% so far in 2025. I don't expect that performance to repeat in 2026, but I still think it has market-beating potential.

Image source: Getty Images.

Its core business is thriving

Alphabet's primary business is the Google Search engine. At the start of 2025, a large majority of investors assumed that generative AI technologies would replace Google. However, Alphabet saw the writing on the wall and made swift changes.

The biggest innovation was the integration of AI-powered Overviews in Google Search. These provide nearly every search result with a generative-AI summary at the top of the page, giving the user a hybrid experience.

For many, these will be the most AI capabilities that they need. For others, Google's generative AI model, Gemini, has emerged as a top option in the space.

In one year, Gemini has risen from the laughingstock of the AI world to one of the best. Its improvements were so impressive that they forced OpenAI, the makers of ChatGPT, to declare a "code red" at the company. That's a long way from where Gemini was viewed entering 2025, and the change in fortunes for both the Google Search business and the progress of Alphabet's generative AI model can be thanked for its stock performance.

NASDAQ: GOOGL

Key Data Points

Another area that boosted Alphabet's stock was the performance of its cloud computing division, Google Cloud, which is building out excess computing capacity to rent to those who cannot build their own data centers. Within Google Cloud, Alphabet provides access to its custom tensor processing units (TPUs), which can outperform graphics processing units (GPUs) when the workload is properly configured.

These computing units have been Alphabet's secret weapons in training its cutting-edge generative AI models, and locking access to them behind one of its other business units is genius. However, management may be exploring alternative territory.

Reportedly, the company is considering selling its TPUs to Meta Platforms outright instead of requiring it to rent access to them via Google Cloud. That's a step in a different direction and could result in a new revenue stream that investors haven't accounted for. The AI computing market is huge, and if Alphabet can secure a sliver, it could provide serious growth.

Time will tell if this business venture pans out, but Alphabet is doing incredibly well as a company. It's also spending responsibly, which is something that not every company can say.

Alphabet has plenty of cash to fund its build-outs

One of the growing concerns in the AI realm is a potential bubble forming around building AI computing capacity. There are questions about how AI hyperscalers will fund it, which is a perfectly acceptable question to ask of a company like OpenAI. However, Alphabet has plenty of cash flow to continue building data centers as it pleases.

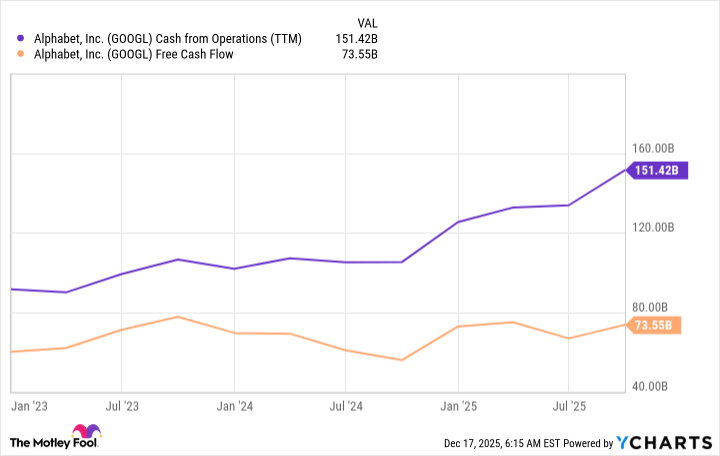

The two metrics that inventors in this realm should familiarize themselves with are operating cash flow and free cash flow. Operating cash flow is all of the cash that a business produces, which can be used to fund capital expenditures (capex). Free cash flow subtracts capex, which shows the remaining cash a business has to repurchase shares, pay down debt, or fund dividends.

GOOGL Cash from Operations (TTM) data by YCharts; TTM = trailing 12 months.

Alphabet has plenty of cash to continue spending on AI data centers if it chooses, which is a great position to be in. While it is spending a lot of its cash on build-outs, it has plenty left before it risks dropping into negative figures. That's a huge advantage the company has over nearly any other competitor in the AI race, and it's the primary reason I think Alphabet is one of the best AI stocks to buy in 2026 and hold for several years after.