The U.S. economy has a history of producing the world's most valuable companies. United States Steel became the first $1 billion enterprise on the planet in 1901, and 117 years later in 2018, iPhone maker Apple became the first to cross the $1 trillion milestone.

Eight other American companies have since joined Apple in the trillion-dollar club, including Nvidia, Alphabet, Amazon, and Tesla, just to name a few. It looked as though Oracle (ORCL +6.63%) was set to join them back in September when its market capitalization reached a peak of $940 billion, but following a 41% decline in its stock price since then, the company is now valued at just $550 billion.

Recent stock price performance aside, artificial intelligence (AI) developers are lining up to rent Oracle's data center infrastructure, which is fueling a surge in the company's revenue. Therefore, is it only a matter of time before this tech titan charts a path back towards the $1 trillion club?

Image source: Getty Images.

A leader in AI infrastructure

Most AI development happens inside large, centralized data centers fitted with thousands of advanced chips called graphics processing units (GPUs), which are supplied by companies like Nvidia and Advanced Micro Devices. It can cost billions of dollars to build a single data center, and since most businesses don't have that kind of money, they rent computing capacity from specialized operators like Oracle instead.

Oracle's data center infrastructure is among the best in the industry. It uses a proprietary random direct memory access (RDMA) networking technology which moves data between chips and devices more quickly than traditional Ethernet networks. Since most AI developers pay for computing capacity by the minute, even a minor increase in processing speed can result in major cost savings over time.

Oracle's data centers also offer significant scale, enabling developers to tap into clusters of over 131,000 GPUs from Nvidia and AMD, which is enough to handle even the most advanced AI workloads.

At the conclusion of its fiscal 2026 second quarter (ended Nov. 30), Oracle had 147 data center regions up and running with 64 more in the pipeline, so it's bringing capacity online at a rapid pace. OpenAI, Elon Musk's xAI, and Facebook parent Meta Platforms are just a few of the AI juggernauts using Oracle's infrastructure.

Oracle Cloud Infrastructure revenue is soaring

Oracle generated $16.1 billion in total revenue during the fiscal 2026 second quarter, which was a modest 14% increase from the year-ago period. But revenue from the Oracle Cloud Infrastructure (OCI) segment, specifically, soared by 66% and came in at a record $4.1 billion.

OCI could be growing its revenue even faster, but Oracle simply can't build data centers fast enough to meet demand from AI developers. That's why the company's remaining performance obligations (RPO) rocketed higher by a whopping 438% year over year to $523 billion during the second quarter. RPO is like an order backlog, because it reflects the value of signed contracts with customers for services which haven't been delivered yet.

Around $300 billion of Oracle's RPO is reportedly from one customer, OpenAI, which creates concentration risk. OpenAI is still a startup and it doesn't have anywhere close to $300 billion in cash on hand, so it will have to become a raging success or else this enormous commitment might never convert into revenue for Oracle.

NYSE: ORCL

Key Data Points

Skepticism about this deal is part of the reason Oracle stock has plummeted by 41% from its September peak. The company has around $108 billion in debt, and it's taking on even more to fund the construction of more data centers. The idea that one of its top customers might never have the money to rent all of this upcoming capacity is spooking investors.

Will Oracle join the $1 trillion club?

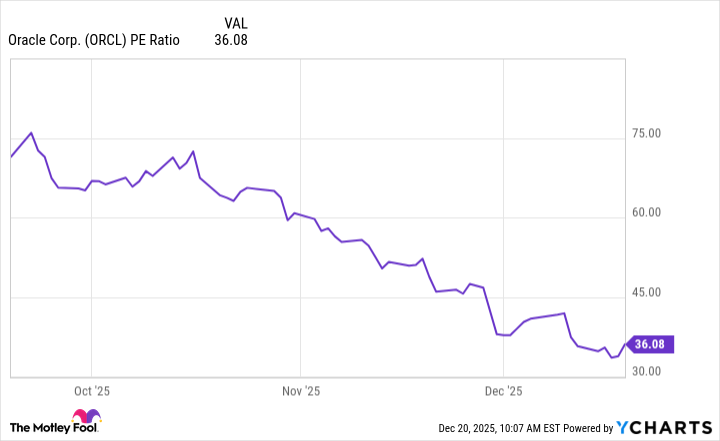

Oracle generated earnings of $5.32 per share over the last four quarters on a generally accepted accounting principles (GAAP) basis, which places its stock at a price-to-earnings (P/E) ratio of 36.1. That is a premium to the Nasdaq-100 technology index which trades at a P/E ratio of 32.1, so even though Oracle stock is down 41% from its September peak, it still isn't cheap.

ORCL PE Ratio data by YCharts

As I mentioned earlier, Oracle has a market cap of $550 billion, meaning its stock would have to soar by 82% for the company to join the $1 trillion club. If we assume Oracle's P/E ratio remains exactly where it is right now, that means the company will have to nearly double its earnings per share to justify a trillion-dollar valuation. If its P/E ratio declines further, it will have an even steeper mountain to climb.

Oracle's AI business is growing at a lightning fast pace right now, so there's a good chance the company joins the $1 trillion club at some point in the future, but it probably won't be the next member of this exclusive club. Several other American companies are much closer to the mark; Walmart has a market cap of $911 billion, so it's a stone's throw from the trillion-dollar milestone, and JPMorgan Chase is also in touching distance with a current value of $872 billion.