Source: ONEOK Partners

With the oil crash having crushed so many energy stocks, even steady income payers like midstream MLPs, dividend lovers might be understandably nervous about investing in this industry. Take for example ONEOK Partners (OKS +0.00%) and its general partner ONEOK Inc. (OKE 0.06%).

Do these two pipeline investments represent an incredible long-term income opportunity? Or is the market right to punish them so badly? To help you decide if ONEOK Partners and ONEOK Inc. deserve a spot in your diversified income portfolio let's look at three important factors that are likely to determine whether or not ONEOK can supercharge your portfolio in the years to come.

Historically cheap

| Company/MLP | Yield | 5 Year Average Yield | Price/Operating Cash Flow | 19 Year Average Price/Operating Cash Flow |

| ONEOK Partners | 11.6% | 5.9% | 6.7 | 9.5 |

| ONEOK Inc. | 9.9% | 3.6% | 5.3 | 7.6 |

As you can see both ONEOK Partners and ONEOK Inc. are trading at substantial historic discounts, both with respect to yield and price to operating cash flow. However, anytime the market offers such high-yields one must carefully examine the business model and payout profile to see whether its cash flow are sufficient to maintain the current payout, both now and in the future.

Upon closer inspection it becomes obvious why Wall Street is valuing ONEOK at such distressed valuations.

Payout profile: red flags but management remains confident

| Metric | ONEOK Partners | ONEOK Inc. |

| Q1-Q3 2015 DCR | 0.8 | 1.24 |

| Q1-Q3 Excess DCF (Annualized) | -$265.6 million | $122.5 million |

| 5 Year Analyst CAGR Projected Payout Growth | 1.1% | 4.5% |

While ONEOK Inc.'s coverage ratio seems to indicate that its dividend is sustainable keep in mind that ONEOK Inc. derives its cash flow from the distributions and incentive distribution rights fees it receives from its MLP. This means that should ONEOK Partners cut its payout its general partner would likely have to do so as well.

The reason for ONEOK Partners' difficulties in covering its distribution (thus explaining the low projected payout growth rates) is because of relatively high exposure to commodity prices, especially in natural gas liquids or NGLs, the prices of which are at multi-year lows due to both a glut of natural gas and liquids rich oil from which they are derived.

On November 3, 2015 ONEOK's management recently reassured investors that new upcoming projects will, assuming energy prices don't decline further, result in a coverage ratio of 1.0+ and 1.3 for the MLP and GP respectively.

However, as seen in recent weeks, energy prices are incredibly volatile and could very well fall to levels that invalidate management's guidance so investor's should take such reassurances with a grain of salt. That being said ONEOK does have two things working in its favor that might make these two investments attractive high-risk investments.

Improving contract mix means more stable DCF going forward

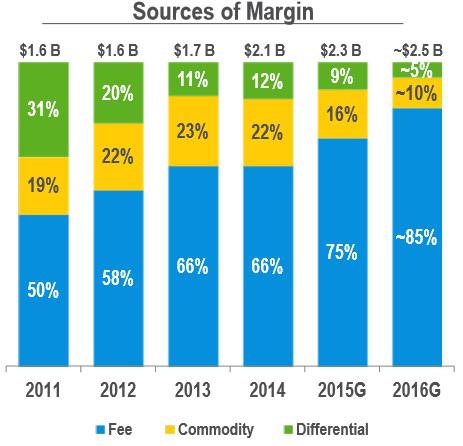

Source: ONEOK Partners investor presentation.

As you can see ONEOK is steadily moving away from commodity sensitive contracts and focusing on more steady fee-based agreements. This includes an increased focus on natural gas pipelines, such as the upcoming Roadrunner pipeline which has a 25 year contract to export natural gas to Mexico starting in Q1 of 2016.

Natural gas represents ONEOK's best business both because 96% of its margin is fee based, and because its volumes are demand based. This means that pipeline volume is being driven by customers buying gas rather than producers drilling and producing it, which minimizes the risk to cash flow should gas prices stay cheap or fall further.

Continued access to growth capital...at least for now

| Metric | ONEOK Partners | ONEOK Inc. |

| Debt/EBITDA (Leverage) Ratio | 4.7 | 5.7 |

| Average Debt Cost | 4.3% | 4.3% |

| Operating Income/Interest (Interest Coverage) Ratio | 3.22 | 2.7 |

| Historic Funding Sources | 46% debt, 54% equity | 61% debt, 39% equity |

| WACC | 6.48% | 6.92% |

| ROIC | 7.89% | 9.43% |

Sources: Morningstar, Gurufocus

Normally you want to see a midstream MLP's leverage ratio below 4.5 since this is one of the most important factors that credit ratings look at when rating pipeline operators. However, while ONEOK's leverage ratios are higher than this they are below the industry average of 6.6.

This means that ONEOK should still have some access to debt markets which is important given that low share prices mean have made funding growth or debt refinancing through equity much more expensive. Combined with increasing debt costs in a long-term rising interest rate environment, this could drive its weighted average cost of capital high enough to make future investments unprofitable.

Thus ONEOK rallied strongly when, on January 11 ONEOK announced a new three year $1 billion unsecured loan that management claims will cover its capital needs "well into 2017".

Bottom line:

ONEOK Partners and ONEOK Inc. may not be the highest quality midstream MLPs in the industry but their recent debt offering gives the MLP breathing room (at least in 2016) to continue growing its cash flow in the hope of securing and potentially growing its distribution once energy prices recover.

That being said potential investors need to realize that an investment in ONEOK is highly speculative and largely dependent on commodity prices, especially oil and NGLs recovering by mid 2017 when ONEOK will likely once more have to raise capital. However, should energy prices fall in 2016 be aware that management's optimistic guidance may fall far short of expectations and result in painful payout cuts for both investments.