Johnson and Johnson (NYSE: JNJ) is a financially sound, blue chip favorite among generations of investors.

But many investors already hold it as a core position, and while they may be sorely tempted to top up their holdings, it's always a mistake to depend too heavily on the performance of a single stock. In addition, the company looks expensive right now, so it may make sense to wait for a pullback before buying again.

So where should investors be looking for diversification alternatives to J&J that offer better dividends? Without further ado, here are three stocks our contributors believe could be better choices.

Brian Feroldi: Investors might not be as familiar with the name AbbVie (ABBV 0.66%) as they are with Johnson & Johnson, but if dividends are what they are after then I'd suggest giving this pharma giant a closer look.

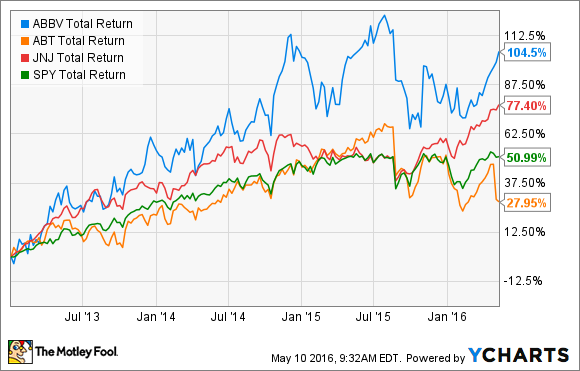

AbbVie's stock hit the public markets in 2013 after being spun out of its former parent (and dividend aristocrat) Abbott Laboratories (ABT 1.25%). Investors who purchased AbbVie after it became available have done very well over the years as its stock has crushed the returns of Johnson & Johnson, Abbott Laboratories, and the S&P 500 in general over that time period.

AbbVie's market performance has largely been driven by the success of its mega-blockbuster chemotherapy and immunosuppressant drug Humira. In 2015 sales of Humira were more than $14 billion, making it the top-selling drug in the world. What's even more impressive is that even with its massive sales Humira is still growing at impressive rates, as on a currency neutral basis this drug grew more than 19% year-over-year.

Of course, there is a downside to having such a massive winner like Humira in its lineup. Last year Humira accounted for more than 60% of AbbVie's total revenue, which has many investors worried. After all, one of Humira's key U.S. patents will expire at the end of this year, which some believe could open it up to biosimilar competition. That's a real threat, and if Humira sales were to stall or decline then AbbVie's investors could be in for a world of hurt.

Thankfully, management is well aware of this risk and they have done their best to assure investors that its AbbVie's future still looks bright. Management believes that Humira is well protected from competitor until at least 2022, and when you add in the fast growth of newer drugs like its Hepatitis C cure Viekira Pak and its cancer drug Imbruvica they believe that sales in 2020 will top $37 billion. That guidance suggests that annual revenue and earnings growth will be in the double-digits over the next few years.

If you are a believer in management's long-term outlook than AbbVie's currently stock looks like a bargain. It's trading for 11 times next years earnings estimates and offers up a dividend yield of 3.65%. That's a compelling combination for a stock that could grow at an above average rate, so I think that AbbVie's stock is the smarter dividend play than that of Johnson & Johnson.

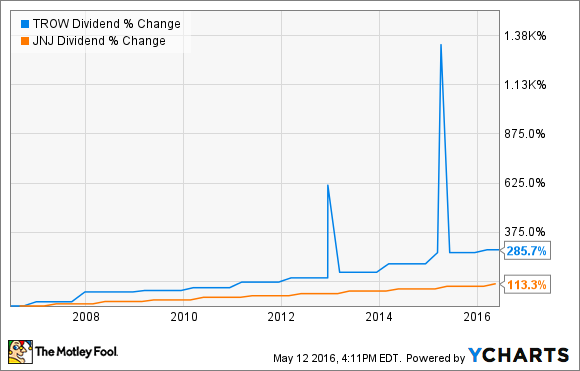

Cory Renauer: Financial services stocks have taken it on the chin over the past year, dragging T. Rowe Price Group (NYSE:TROW) down along with its peers. As a result it’s dividend yield is a juicy 2.9%, just a bit above J&J’s.

That’s hardly the only reason I like this company’s dividend better than the healthcare giant’s. The company has raised its distribution at a blazing rate, especially in recent years.

Add in the occasional “special” dividend, like the $2.00 per share it paid last April on top of the quarterly $0.52 it paid last March and this highly profitable stock is bound to keep you smiling in the years ahead.

Looking forward, there’s plenty of runway to keep those distribution hikes coming. In light of last year’s whopping special dividend, the most recent increase was a modest 3.8% bump to $0.54 per quarter. The company only used 44.6% of profits recorded during the first-quarter to pay out $135.9 million in dividends to its happy shareholders -- a payout ratio slightly lower than J&J’s 48.2% in the first quarter.

Another reason for the relatively modest dividend raise announced in February, was a prescient decision last December to boost its stock repurchase authorization by 12 million shares to 20.9 million, The stock dipped on fears of a global economic slowdown and rising interest rates, and management scooped up a little over 1.15% of shares outstanding.

The debt-free asset manager has made 30 consecutive annual dividend increases, and will have a few million less pay out as it continues its streak in the years ahead.

Cheryl Swanson: J&J currently yields only about 2.62%, a respectable, but hardly spectacular yield. If you're willing to absorb a little more risk in return for a much higher dividend, I'd suggest HCP (NYSE:HCP ) , the only real estate investment trust (REIT) in the S&P Dividend Aristocrats Index. With a 6.74% yield, HCP makes its money by renting out healthcare properties such as senior living, acute care, and medical office buildings.

As any investor who survived the recession of 2007 to 2009 can attest, the real estate market can be very unstable. But health care REITs tend to be less so, because governments and individuals cannot cut back on health care spending, no matter how good or bad the overall economy is.

In particular, HCP holds 1,200 properties and has recently increased its dividend yet again, marking 31 consecutive years. Still, it's a mistake to assume that a Dividend Aristocrat is invincible, and HCP has faced murky headwinds due to some of its facilities reliance on Medicare and Medicaid reimbursements, which can unexpectedly shift and make the business less profitable.

That's why HCP's last quarter surprise announcement (and terrific earnings) should see this stock heading right back up again. Management solved its biggest problem by announcing the spin-off of government reliant Manorcare into a separate REIT, which should improve HCP's financial position and stability. In fact, with the company's exposure to ManorCare ending, I see an opportunity for more annual total return potential than J&J.