If you have a Roth 403(b), the account won't be subject to RMDs.

Most plan administrators will automatically calculate and distribute RMDs to participants when they turn 73. If you fail to take the distribution, however, you'll be subject to a 25% tax, and you'll still need to take the distribution. If you correct your mistake within two years, the penalty is reduced to just 10%.

403(b) rollover options

Rolling over a 403(b) into another retirement account is likely the best strategy for someone after they switch jobs or leave the workforce. 403(b) plans often charge administrative fees on top of fees for the mutual fund options in the plan. Rolling over funds to a different account can open less expensive and more flexible options.

Rolling over a 403(b) account is technically a distribution. But because you're depositing the funds into another tax-advantaged retirement account, you won't pay any early withdrawal penalty or taxes. The only caveat is you must deposit any 403(b) distributions into a qualified account within 60 days of receiving it. Often, a plan administrator or financial institution will transfer assets automatically, which will ensure the process happens quickly.

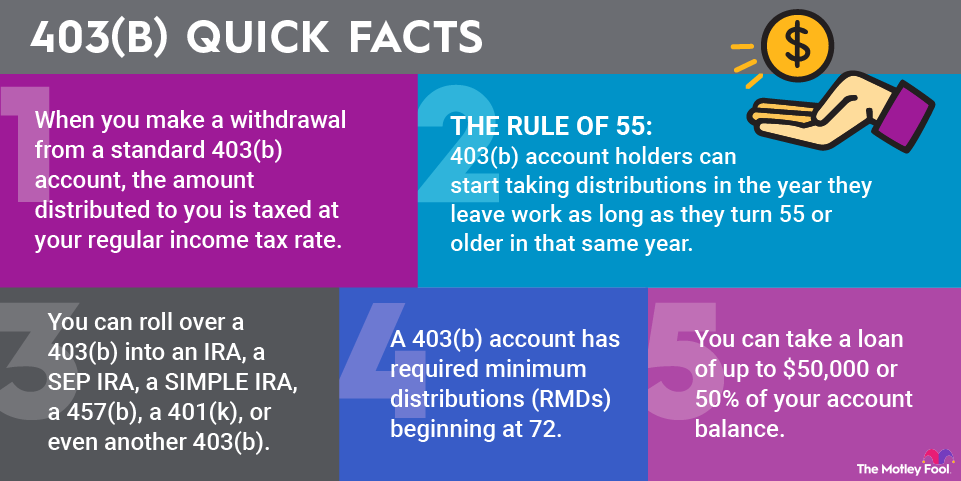

You can roll over a 403(b) into an IRA, a SEP IRA, a SIMPLE IRA, a 457(b), a 401(k), or even another 403(b). You can roll over the funds into a designated Roth account in any of those plans, but you'll owe income taxes on the entire amount unless the rollover comes from a designated Roth 403(b) account. Note that Roth 403(b) accounts cannot be rolled over into pre-tax retirement accounts -- only other Roth accounts.