Circumstance-based borrowing

Q: Can you borrow from an IRA to buy a house or do home improvements?

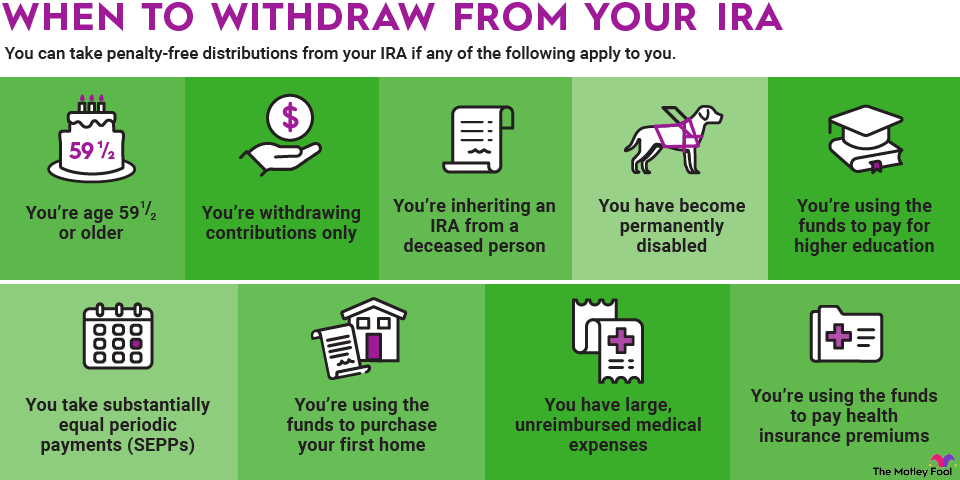

You can access certain IRA funds to help you buy your first home. Note that the IRS generally treats you as a first-time homebuyer if you haven't owned a primary residence within three years.

You can withdraw up to $10,000 without penalty from a traditional IRA or your Roth IRA earnings. (Remember, under Roth IRA rules, you can access your contributions but not your earnings at any time without tax or penalty.) The same provision doesn't exist for home improvements, though.

You could, in theory, remove money from a traditional IRA, pay for home improvements, and then return the full withdrawal amount to your account within 60 days without taxes or penalty. However, it would be rather unusual for this to be a recommended personal finance option.

Q: Can you borrow from an IRA to buy a car?

There is no specific provision that would allow for this. Still, as with the above example, it would be technically permissible to withdrawal money from your IRA, buy a car, and then return the full proceeds to your IRA within 60 days. This might work if you're expecting a large cash inflow during that 60-day period. But generally, using IRA funds to buy a car -- unless you're already retired -- is not the best idea.