You can use an indirect rollover to withdraw funds for 60 days and then replace them in the same account. This allows you to borrow funds for a very short time, but do this with caution. You could face stiff penalties if you don't return the money within 60 days.

One IRA rollover per year

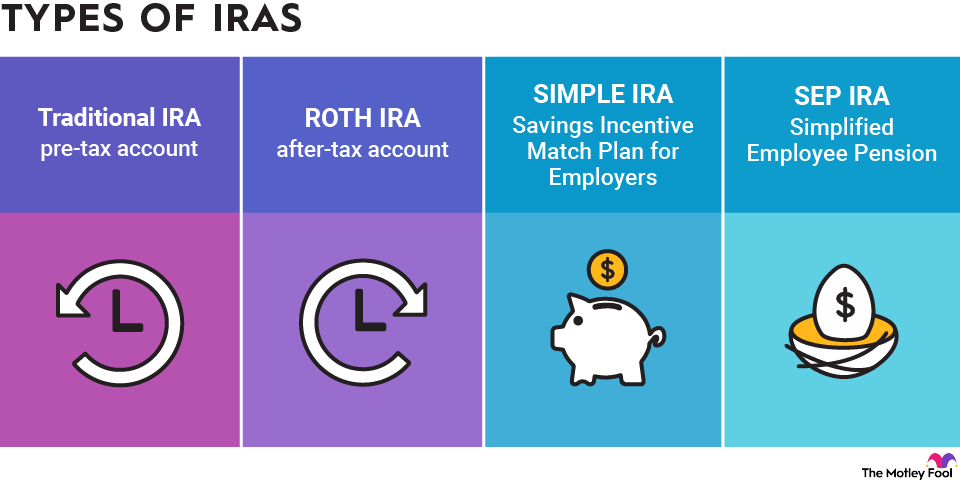

If you're rolling over funds from a traditional IRA, SIMPLE IRA, or SEP-IRA to another one of those types of accounts, you're eligible to do that only once per rolling 12 months. Importantly, the one-IRA-rollover-per-year rule doesn't apply to rollovers from a tax-deferred IRA account to a Roth account, which is actually a conversion. It also doesn't apply to rollovers to or from employer-sponsored retirement plans.

If you don't follow this rule, every rollover after your first could be subject to the 10% early withdrawal penalty, and you'll have to pay taxes on the distribution. You could also face a penalty for contributing too much to your IRA if you put funds back into your brokerage account that aren't eligible for a rollover.

The same-property rule

When you execute a rollover, you have to contribute the same property that you withdrew from your original brokerage account. If, for example, you received a check for an indirect rollover, bought some stock with the distribution proceeds, and then tried to transfer that stock to another retirement account, you'd violate the same-property rule.

If you violate the same-property rule, the distribution will be treated as a normal withdrawal, which you'll have to pay taxes on, and you could owe a 10% early withdrawal penalty on it as well.

Distributions ineligible for rollover

Some distributions from your workplace retirement plan are ineligible to be rolled over into an IRA. For example, required minimum distributions are ineligible, as are loans and hardship withdrawals.

Limits

There is no limit on the amount you can roll over into an IRA. A rollover will not affect your annual IRA contribution limit either.

There's also no limit to the number of rollover IRAs you can have. However, it's probably easier to manage fewer accounts. You can use the same IRA to roll over funds from multiple accounts. You can also make regular contributions to that IRA, so you don't really need more than one.