A self-directed Roth IRA is a type of retirement account that allows the owner to hold alternative investments. It could be a good fit if you want access to more asset classes than standard retirement accounts allow, but there are also downsides to this type of account.

This guide will explore what a self-directed Roth IRA is, how to open one, the rules surrounding such accounts, and additional factors to consider first.

What is a self-directed Roth IRA?

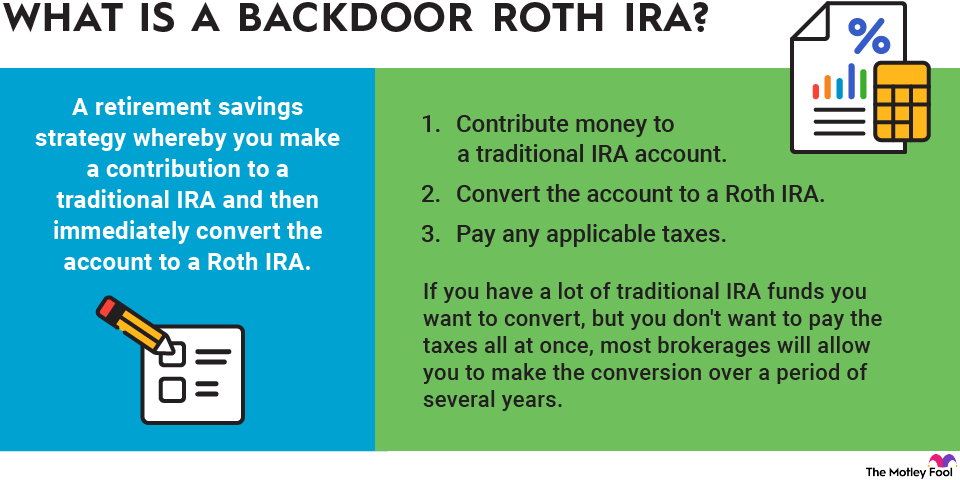

A self-directed Roth IRA is a type of retirement account that receives the same tax-advantaged treatment a regular Roth IRA does. You won't receive any tax benefit in the year you make a contribution, but invested contributions will grow, compound, and receive dividends tax-free. When you withdraw money from a Roth IRA, you generally won't pay taxes either. A self-directed Roth IRA is subject to the regular Roth income limits.

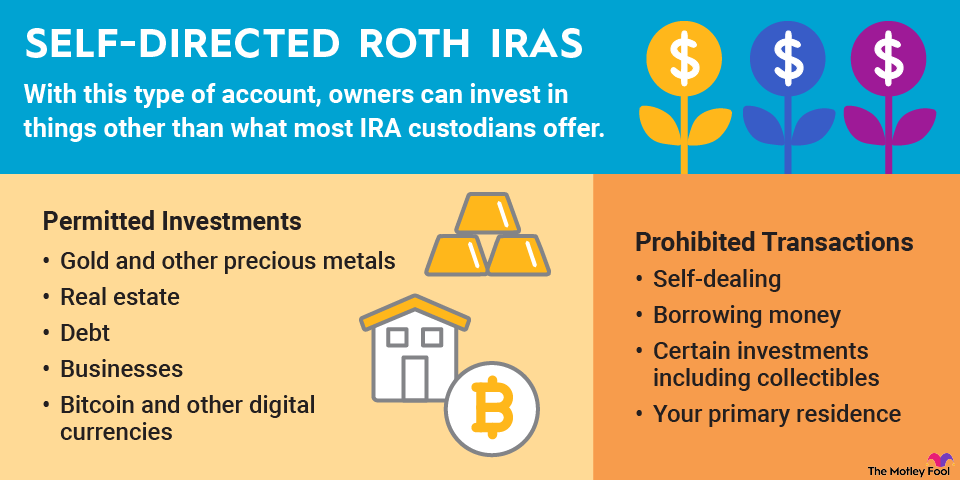

However, in a self-directed Roth IRA, account owners can invest in assets that most IRA custodians don't allow. With a standard Roth IRA, investors are generally restricted to stocks, bonds, mutual funds, exchange-traded funds (ETFs), CDs, and similar investments.

A self-directed Roth IRA has many additional investment choices, such as real estate, precious metals, and cryptocurrency. These assets are considered alternative investments. They have the potential to increase diversification across your retirement assets, but they come with additional risks.

How to open a self-directed Roth IRA

You can open a self-directed Roth IRA with a custodian that offers this type of account. Keep in mind that most of the top Roth IRA providers don't have self-directed accounts available, as they only offer standard IRAs and Roth IRAs.

Custodians that offer self-directed Roth IRAs include IRA Financial, Equity Trust, and The Entrust Group. Check that the custodian has the specific alternative investments you want.

You're responsible for choosing and managing the account's underlying investments. You'll also be responsible for funding and executing the account transactions. If you need ongoing assistance with selecting investments, consider working with a financial advisor who's a fiduciary for professional guidance.

Borrowing money

You are not permitted to borrow money from your self-directed Roth IRA, or any IRA for that matter. Borrowing money is also a form of self-dealing in that, by borrowing from your IRA, you're essentially conducting business with yourself.

There is a loophole, known as the 60-day rollover rule. You can make a withdrawal from an IRA, including a self-directed Roth IRA, if you redeposit the entire amount in a qualified retirement account within 60 days. The retirement account could be a new account or the same account where you withdrew the money. This effectively allows for a short-term IRA loan, but you can only do one IRA rollover per 12-month period.

Certain investments

Collectibles and life insurance are the two primary types of prohibited investments for a self-directed IRA. Collectibles include art investments, antiques, jewelry, stamps, or most other items the IRS deems to be collectible.

Life insurance offers contracted protection for those who depend on your income. Due to its very nature, life insurance is not appropriate for a self-directed IRA.

Other prohibited investments include complex derivatives and S corporation shares.

Your primary residence

As briefly noted above, your self-directed Roth IRA is not the place to hold your home. Not only does this give the appearance of self-dealing, but your primary residence is simply not a conduit for stable retirement income.

Is a self-directed Roth IRA right for you?

A self-directed Roth IRA has its pros and cons and is most definitely not for everyone. Further, you should not put money into any of the aforementioned alternative investments if you don't have a thorough understanding of the respective risks. Stock and bond investments, especially in the form of ETFs and mutual funds, are relatively easy to understand, which is why most people are better off sticking to a standard Roth IRA.

However, if you're knowledgeable about the alternative investments on this list -- and you're aware of what transactions are prohibited -- and want to use them as part of a well-rounded retirement strategy, a self-directed IRA could be worth a look.