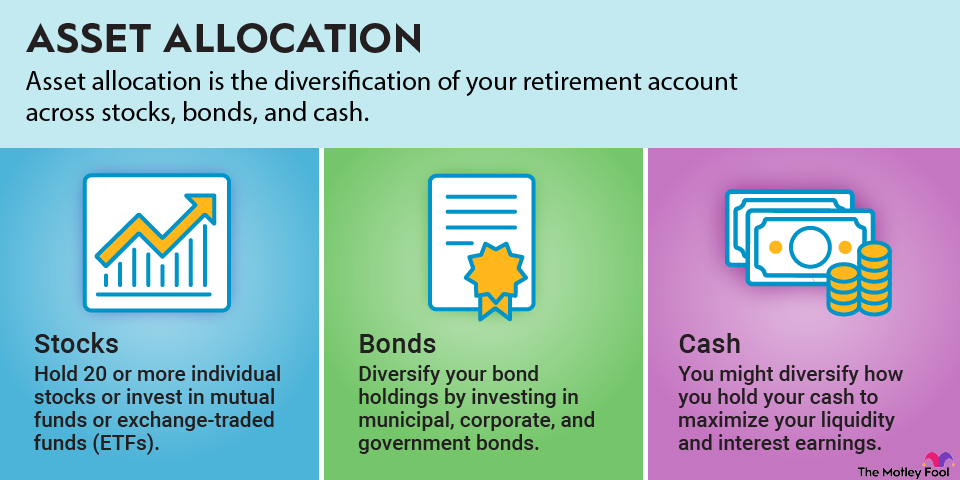

Asset allocation refers to the diversification of your retirement account across various asset classes, including stocks, bonds, and cash.

Your age is a primary consideration when you're managing allocation. The idea is that the older you are, the less investment risk you can afford to take. As you get closer to retirement age, your risk tolerance decreases dramatically, and you can't afford any wild swings in the stock market.

Save those wild rides for the amusement park. You can safely increase your wealth over time and meet your retirement goals by following these five best practices for managing your asset allocation.

1. Adjust your asset allocation according to your age

When your investment timeline is short, market corrections are especially problematic -- both emotionally and financially. Emotionally, your stress level spikes because you had plans to use that money soon, and now some of it is gone. You might even get spooked and sell. And financially, selling your stocks at the bottom of the market locks in your losses and puts you at risk of missing the stocks' potential recovery.

Adjusting your allocation according to your age helps you to bypass those problems. For example:

- You can keep more money in stocks if you're younger. You have plenty of years until you reach retirement and can ride out any current market turbulence.

- As you get older, it's wise to gradually start shifting money out of stocks and into bonds and other fixed-income instruments.

- Once you're retired, an even more conservative asset allocation could make the most sense. We'll get into some ways to determine your ideal asset allocation in the next section.

- Hold any money you'll need within the next five years in savings accounts, CDs, Treasury bonds, or other safe investments.

- Keep your emergency fund entirely in a savings account. As is the nature of emergencies, you may need access to this money with just a moment's notice.

Asset

2. How much of your retirement savings should you invest in stocks by age?

One rule of thumb financial planners often use is known as the Rule of 110. In a nutshell, this formula suggests that by subtracting your age from 110, you can estimate approximately what percentage of your portfolio should be invested in stocks or stock-based funds. The rest belongs in bonds and other fixed-income investments.

For example, if you're 40 years old, this rule implies that you should have about 70% of your portfolio in stocks, with the rest in fixed income.

Age | % Allocated to Stocks |

|---|---|

20 | 90% |

30 | 80% |

40 | 70% |

50 | 60% |

60 | 50% |

Keep in mind that this rule aims to determine your ideal asset allocation solely by your age. However, every person is different. You can adjust the percentages higher or lower to compensate for your own risk tolerance, your desired retirement age, and other factors. can be just as important. Ultimately, the way you allocate your investment portfolio should provide you with peace of mind, regardless of your age.

3. Don't let stock market conditions dictate your allocation strategy

When the economy is performing well, it's tempting to believe that the stock market will continue to rise forever, and that belief may encourage you to chase higher profits by holding more stocks. This is a mistake. Follow a planned asset allocation strategy precisely because you can't time the market and don't know when a correction is coming. If you let market conditions influence your allocation strategy, then you're not actually following a strategy.

4. Diversify your holdings within each asset class

Diversifying across stocks, bonds, and cash is important, but you should also diversify within these asset classes. Here are some rules of thumb to help you do that:

Stocks:

Investing in individual stocks isn't right for everybody. But if you choose to go this route, it's wise to hold 20 or more individual stocks to prevent relying too much on any single investment's performance. Alternatively, you can invest in mutual funds or exchange-traded funds (ETFs).

You can diversify your stock holdings by individual company and market sector. Utility companies, consumer staples, and healthcare companies tend to be more stable, while the technology and financial sectors are more reactive to economic cycles.

Mutual funds and ETFs are already diversified, and that's especially true when it comes to index funds that track broad indexes like the S&P 500.

Bonds:

Buying individual bonds can be a clunky and complex process. For most investors, the best way to go is investing in bond funds. The different types of bonds available are primarily municipal, corporate, and government bonds. There are excellent low-cost index funds for each type.

Cash:

Cash doesn't lose value like a stock or bond can, so diversifying your cash holdings doesn't necessarily need to be a priority. And to be clear, by "cash," we mean a savings account or CD, not physical cash.

If you have a large amount of cash, you may consider holding it in separate accounts at different banks, ensuring that all of it is FDIC-insured. The FDIC limit is typically $250,000 per depositor, per bank.

One smart strategy is to diversify how you hold your cash to maximize your liquidity and interest earnings. For example, you could hold some cash in a liquid savings account and the rest in a less-liquid certificate of deposit (CD) with a higher interest rate than a standard savings account.

5. Invest in a target-date fund that manages asset allocation for you

If you're nodding off just reading about asset allocation, there is another option. You could invest in a target-date fund, which manages asset allocation for you. A target-date fund is a mutual fund or ETF that gradually moves toward a more conservative allocation as the target date approaches.

The target date is referenced in the fund's name and denotes the year that you plan to retire. A 2055 fund, for example, is designed for folks who plan to retire in 2055.

Target-date funds typically adhere to asset allocation best practices. They're diversified across and within asset classes, and the allocation takes your age into account. These funds are also easy to own. You personally don't have to actively manage your allocation or even hold any other assets -- except for the cash in your emergency fund.

Even so, there are drawbacks. Target-date funds don't account for your individual risk tolerance or the possibility that your circumstances may change. You might get a big promotion that enables you to retire five years earlier, for example. In that case, you'd want to review the allocations in your portfolio and decide if they still make sense for you.

Related retirement topics

Make (and follow) your own rules, too

No single approach to asset allocation addresses every scenario perfectly. Carefully consider your risk tolerance and when you plan to retire to establish an approach that works for you. You could also wing it -- but make sure that your seat belt is firmly buckled because it could be a wild ride.