A small-cap index fund is a type of exchange-traded fund (ETF) that tracks an index of small-cap stocks. Small-cap index funds are invested in all the stocks of a small-cap-focused index, such as the Russell 2000, with the goal of matching the performance of the index.

Small-cap index funds give investors exposure to a broad range of small-cap stocks, which are often the stocks of young companies with smaller profits than more-established companies.

For a small-cap company, the market capitalization, or market cap, which equals share price times the number of shares outstanding, generally falls between $300 million and $2 billion.

Investing in small-cap index funds confers many benefits:

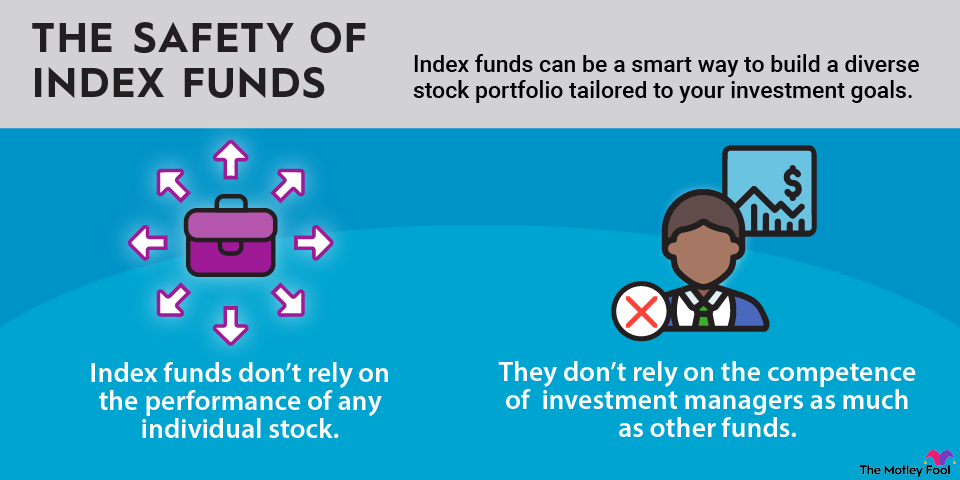

- Portfolio diversification: Investing in a small-cap index fund exposes your portfolio to a wide range of small-cap stocks across different sectors. Diversified portfolios generally perform better than non-diversified holdings because owning the stocks of many different companies ensures that your portfolio's performance is not strongly correlated with the performance of any specific stock and is more resistant to bear markets.

- Risk reduction: Small-cap stocks can be risky since they tend to move cyclically with the broader economic cycle. They are also more volatile than large-cap stocks. Investing in an index fund eliminates some of the risk because the fund gives you a stake in dozens of companies.

- Bull market gains: Although large-cap companies are more likely to be profitable, have better access to capital, and can better withstand recessions, small-cap companies tend to outperform during bull markets, which occur when the stock market is on the rise.

- Attractive growth potential: The stocks of small-cap companies have historically outperformed those of large-caps thanks to their greater growth potential.

The chart below shows that the small-cap Russell 2000 has beaten the large-cap S&P 500 since 1979. The chart also shows that small-cap stocks are more volatile than those of large-cap companies.

However, it's important to note that, due to small-cap stocks' volatility, investors' small-cap holdings are likely to lose more value during market crashes. During the March 2020 crash caused by the COVID-19 pandemic, the values of small-cap stocks fell faster than the value of the broader market, as expected. However, small-cap stock prices also rebounded more quickly.

If you want to gain broad exposure to small-cap stocks, these four small-cap index fund ETFs are good options:

Four best small-cap index funds

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| iShares Trust - iShares Russell 2000 Growth ETF (NYSEMKT:IWO) | $0.0 million | 0.00% | Capital Markets |

| iShares Trust - iShares Core S&P Small-Cap ETF (NYSEMKT:IJR) | $0.0 million | 0.00% | Capital Markets |

| Schwab Strategic Trust - Schwab U.s. Small-Cap ETF (NYSEMKT:SCHA) | $0.0 million | 0.00% | Capital Markets |

| Vanguard Small-Cap Value ETF (NYSEMKT:VBR) | $0.0 million | 0.00% | Capital Markets |

1. iShares Russell 2000 Growth ETF

NYSEMKT: IWO

Key Data Points

As its name implies, the iShares Russell 2000 Growth ETF aims to track Russell 2000 stocks that exhibit growth characteristics.

This ETF has performed well in bull markets but also falls faster when stocks are down. It is at its best when investors are putting money into smaller, more speculative companies. As the fund's name notes, it is focused on growth: It aims to provide exposure to small companies with earnings that are expected to grow at an above-average rate relative to the market.

A growth-oriented fund such as the iShares Russell 2000 Growth ETF carries more inherent risk, but it has a reasonable expense ratio of 0.24% for investors looking for small-cap growth.

2. Schwab U.S. Small-Cap ETF

NYSEMKT: SCHA

Key Data Points

The Schwab U.S. Small-Cap ETF tracks the small-cap holdings of the Dow Jones U.S. Total Stock Market index. This is sort of a middle-of-the-road index fund ETF. It is neither overly conservative nor too aggressive with its holdings. Since it holds a mix of high-risk and low-risk stocks, the risk is lower than it would be for a purely growth-oriented fund. If you're a believer in diversification, this fund provides it.

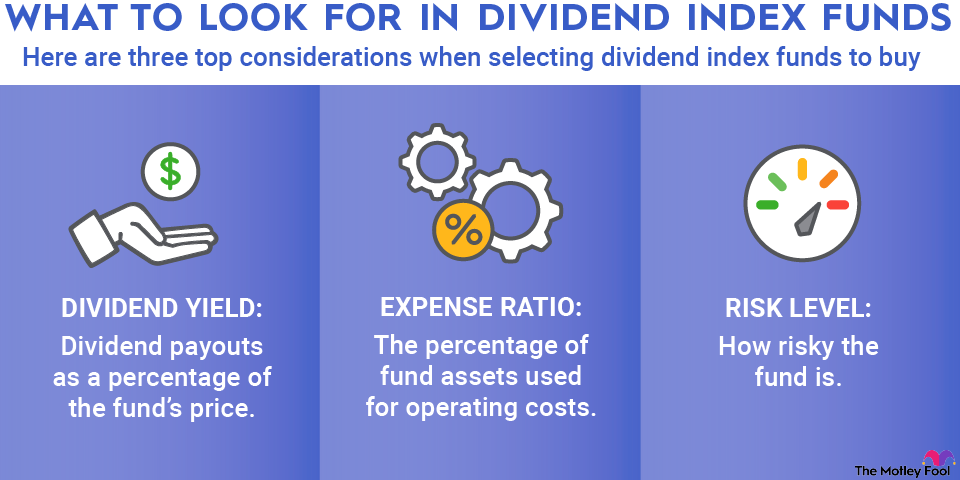

A cheap expense ratio of 0.04%, along with a 10-year compound annual growth rate of more than 7%, including dividends, makes the ETF an appealing way to invest in domestic small-caps. The fund also pays a dividend at a yield of 1.56% of the share price.

3. iShares Core S&P Small-Cap ETF

NYSEMKT: IJR

Key Data Points

The iShares Core S&P Small-Cap ETF, with $86.6 billion in assets, is the biggest small-cap index fund on the market. The fund seeks to track the performance of the S&P Small Cap 600 index by holding a broad array of stocks, including Mueller Industries (MLI +1.31%) and Comerica (CMA +1.00%).

Over the past decade, the index has generated an annual return of almost 8% with dividends. It has an expense ratio of 0.06% and offers a dividend yield of 2%.

Exchange-Traded Fund (ETF)

4. Vanguard Small-Cap Value Index ETF

NYSEMKT: VBR

Key Data Points

The Vanguard Small-Cap Value Index Fund ETF tracks the CRSP U.S. Small Cap Value index. As a value-oriented index tracking fund, the ETF doesn't offer the highest share price growth potential, but it should outperform in bear markets. That's because valuations, especially of high-priced stocks, tend to compress in recessions.

Investors need to be clear about the trade-off they are making when they consider a value fund. This and other value-oriented investments tend to underperform when the markets are soaring, but can provide valuable ballast at times when markets are under pressure.

Currently, the fund offers a dividend of 2% and an attractive expense ratio of 0.07%.

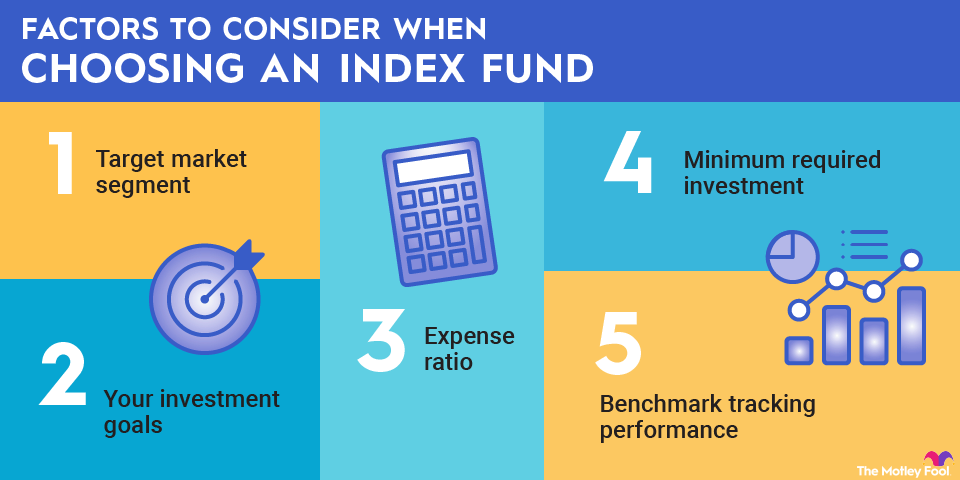

Key Factors to consider when choosing a small-cap index fund

Small-cap stocks are generally considered more volatile than larger companies and can be more vulnerable to market fluctuations and economic headwinds. Investors who tend to worry about market volatility might want to limit their exposure to small-caps.

The best remedy for volatility is time in the market. Small-cap stocks and the funds that house them tend to be better suited as long-term investments, providing the time needed to ride out economic cycles.

When picking between individual funds, investors should be focused on cost-effectiveness. You can't control the direction of the market or the performance of individual stocks. But you can control the fees you pay on your investments. Look for the expense ratios listed on individual fund websites, and try to find low-cost options.

Related investment topics

Is a small-cap index fund right for you?

As you can see from the list above, small-cap investing doesn't have to be complicated. The four index fund ETFs offer a range of benefits, including growth, value, and income, and all have solid track records. With thousands of small-cap stocks available on the market, buying one of these is a smart and convenient way to reduce the risk of investing in the sector by gaining exposure to a wide range of companies with just one or two investments.